“Pipefy is an easy-to-use and highly customizable platform. In addition to being implemented across my main processes, it has proven to be a scalable tool for other processes and teams within my organization.”

Trusted by market leaders

Turn financial operations into intelligent flows with AI Agents.

Implement risk and credit decision orchestration layers in weeks, not quarters. AI Agents take on tasks and support decisions, reducing SLAs and accelerating ROI from the very first flows.

Connect teams, legacy systems, and processes in a single platform

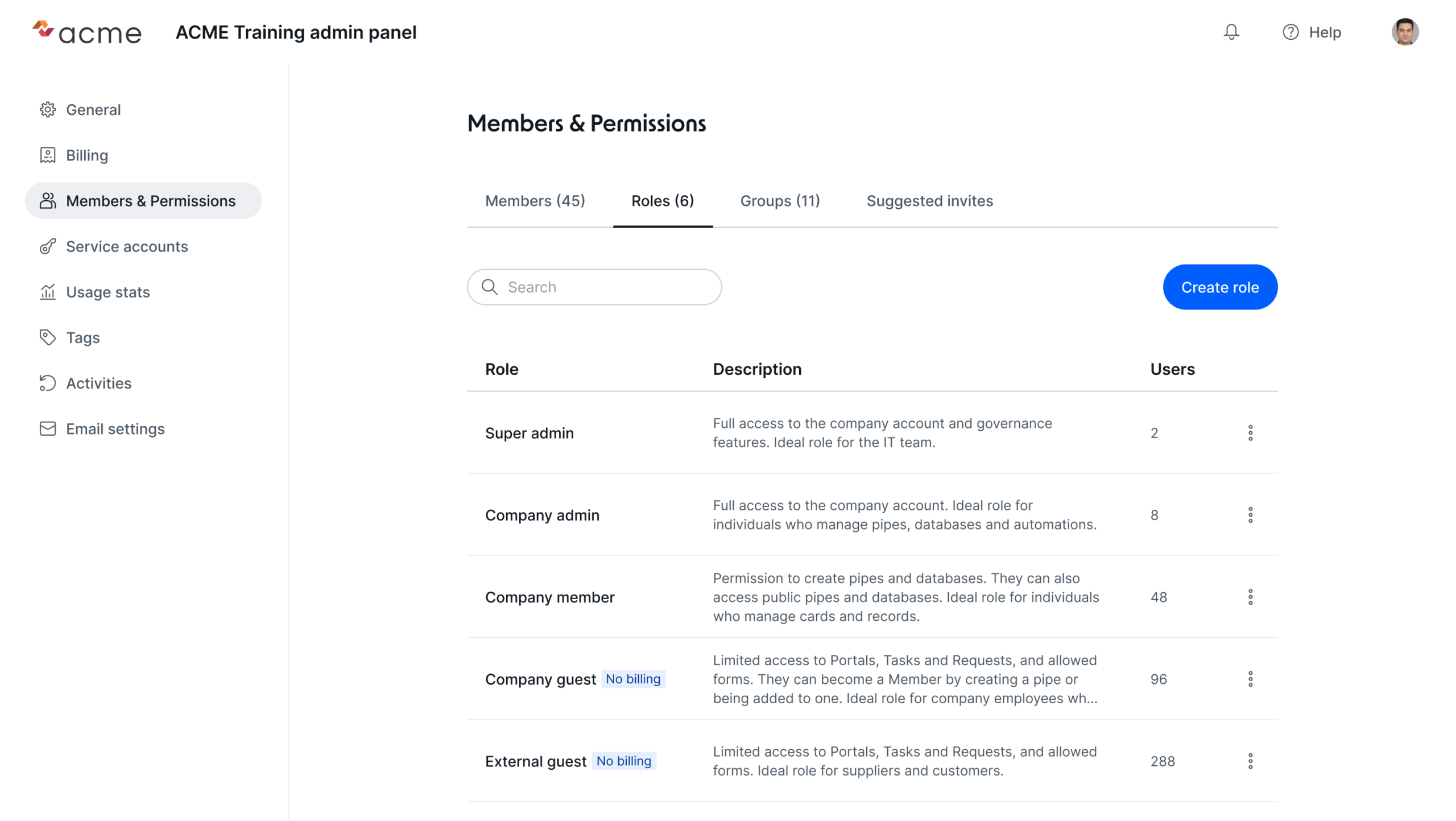

Centralize risk, credit, and compliance in a single orchestration layer. Pipefy connects data, documents, rules, and decisions in auditable workflows, eliminating silos across teams and systems.

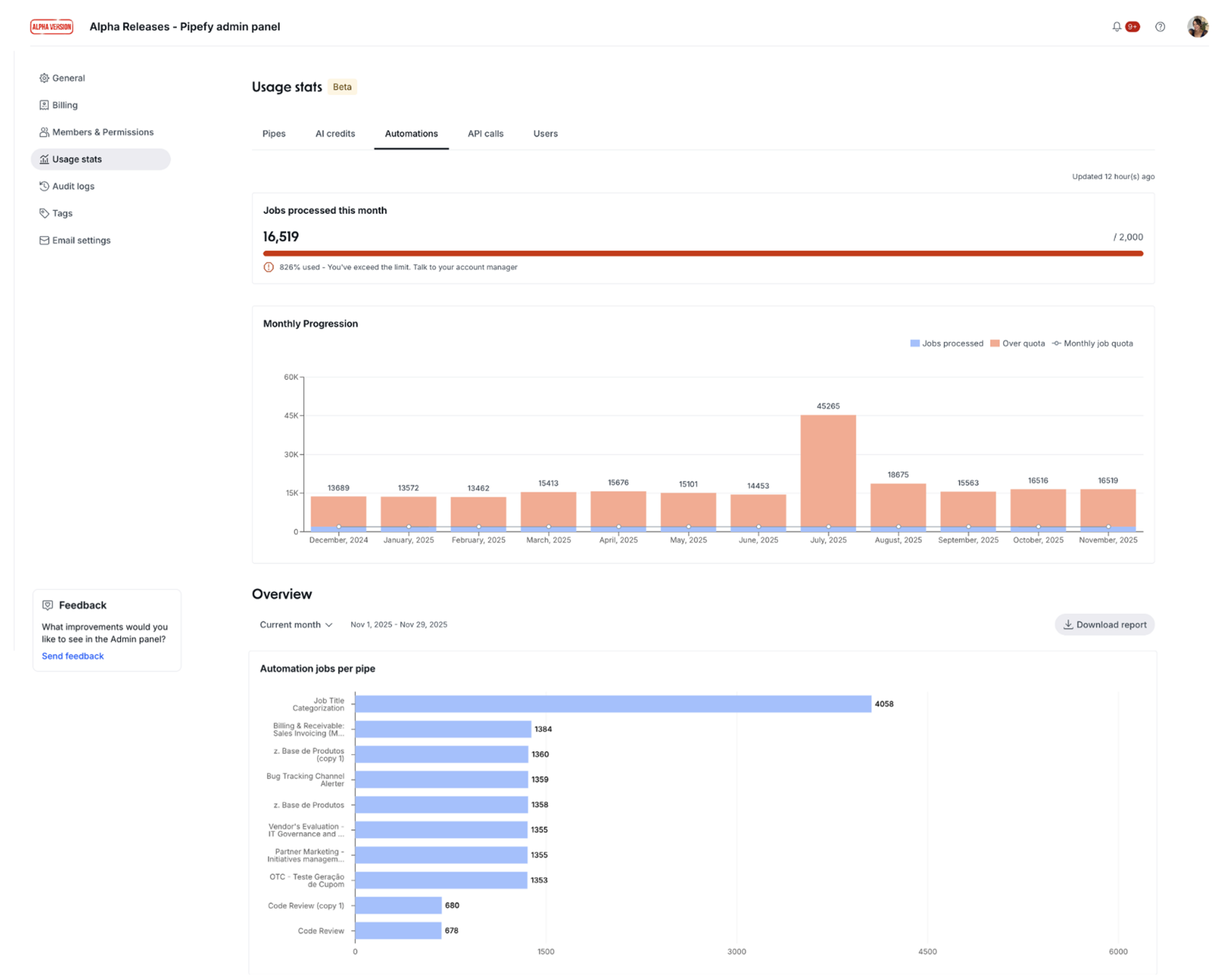

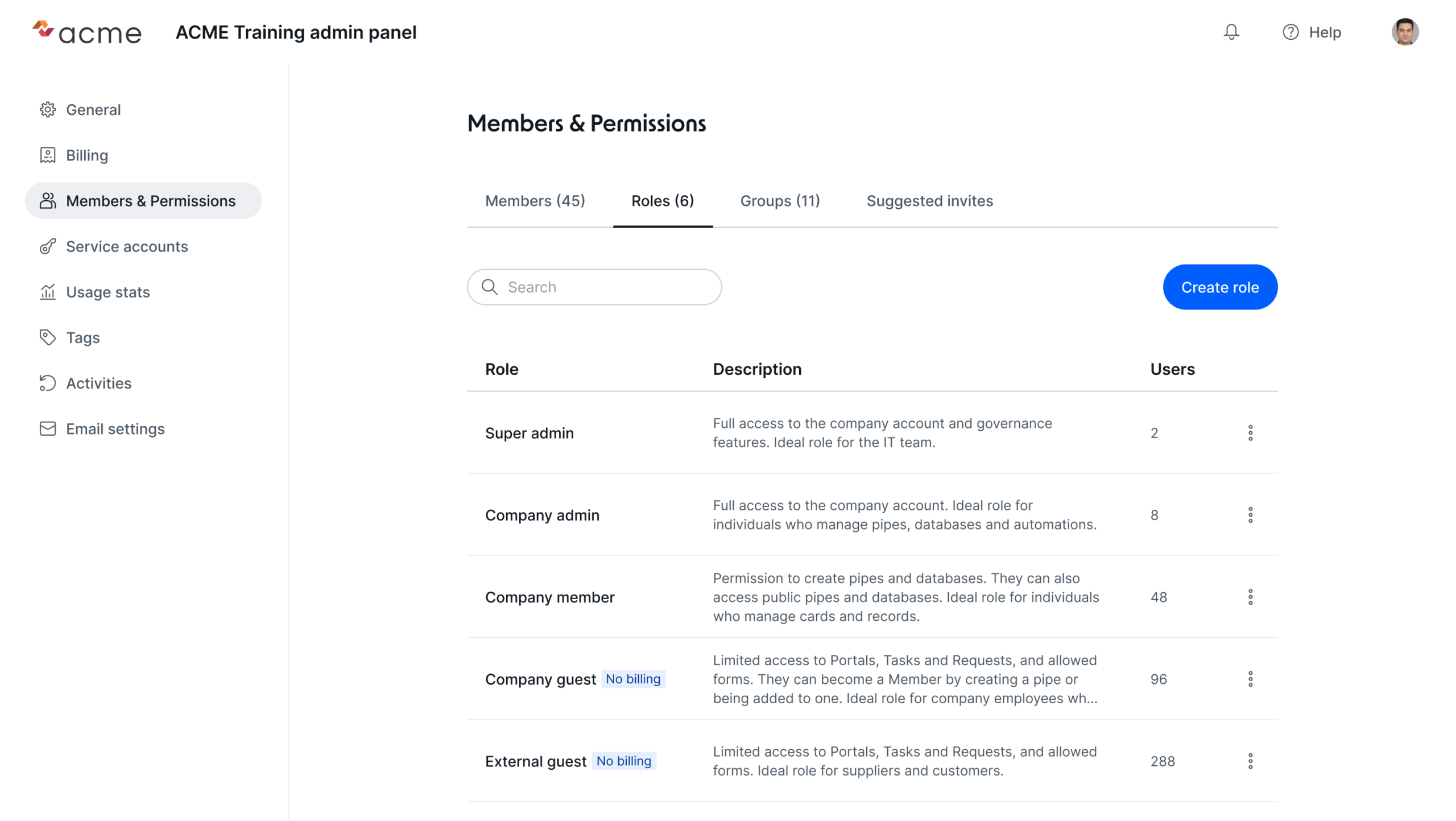

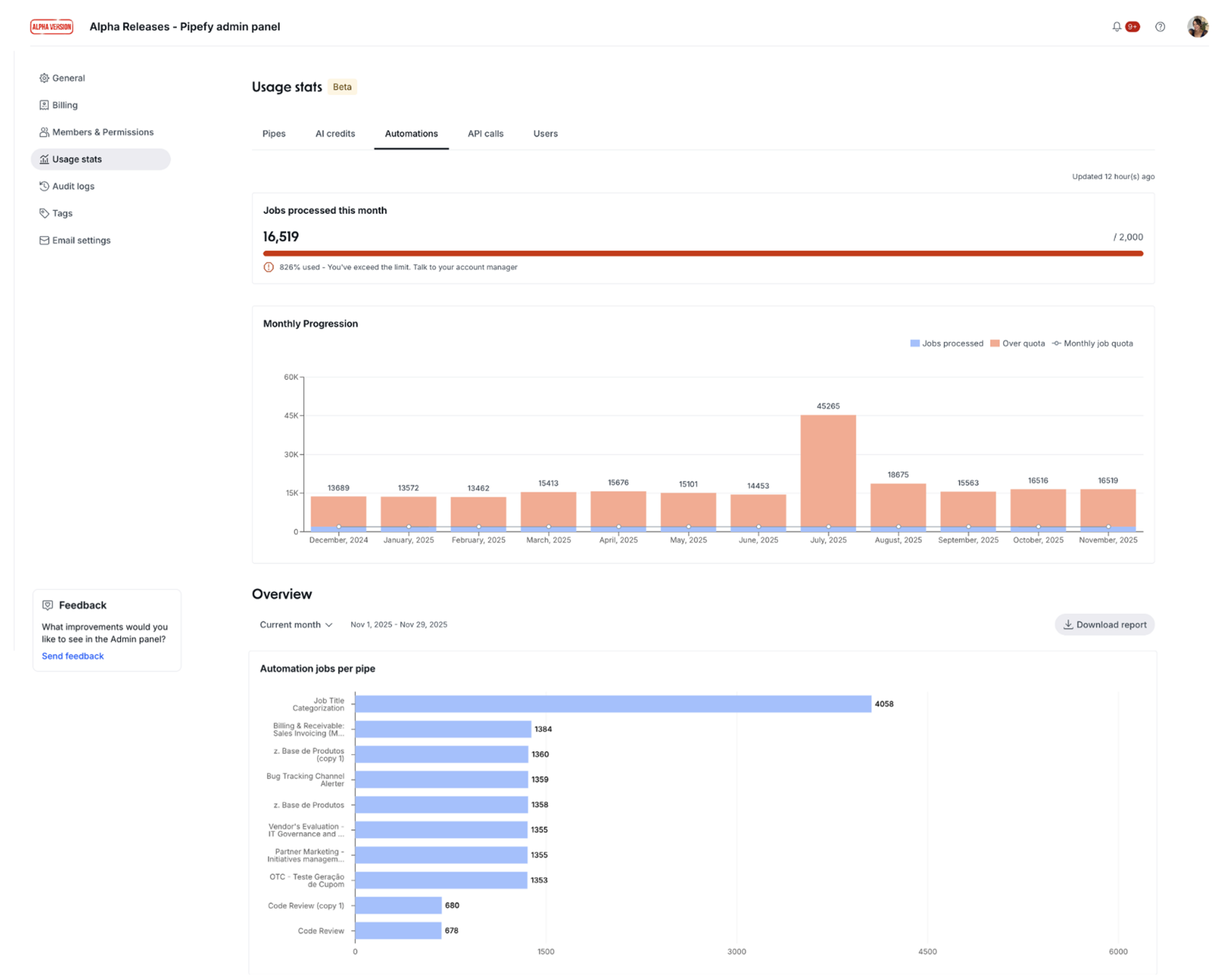

Grow without limits with continuous governance and performance

Scale volume and regulatory complexity without scaling headcount. With no-code and centralized governance, policies evolve safely, maintaining standardization and control even in high-growth operations.

Forrester’s independent Total Economic Impact™ study demonstrated the financial impact Pipefy delivers in complex operations—including critical processes found in Manufacturing Processes.

260%

Return on investment (ROI)

40%

Reduction in process resolution time

50%

Reduction in development time

< 6 months

Average payback period

“Pipefy is an easy-to-use and highly customizable platform. In addition to being implemented across my main processes, it has proven to be a scalable tool for other processes and teams within my organization.”

“Pipefy is a workflow tool we use not only as BPM, but also as an Intelligent Orchestration Platform, integrating multiple digital solutions (such as OCR and Artificial Intelligence) and legacy systems.”

“A modern tool that meets all company needs and delivers quick solutions, supporting the creation and management of procedures.”

Pipefy is one of the most respected platforms in the market, recognized by leaders

for its innovation, robustness, and operational impact.

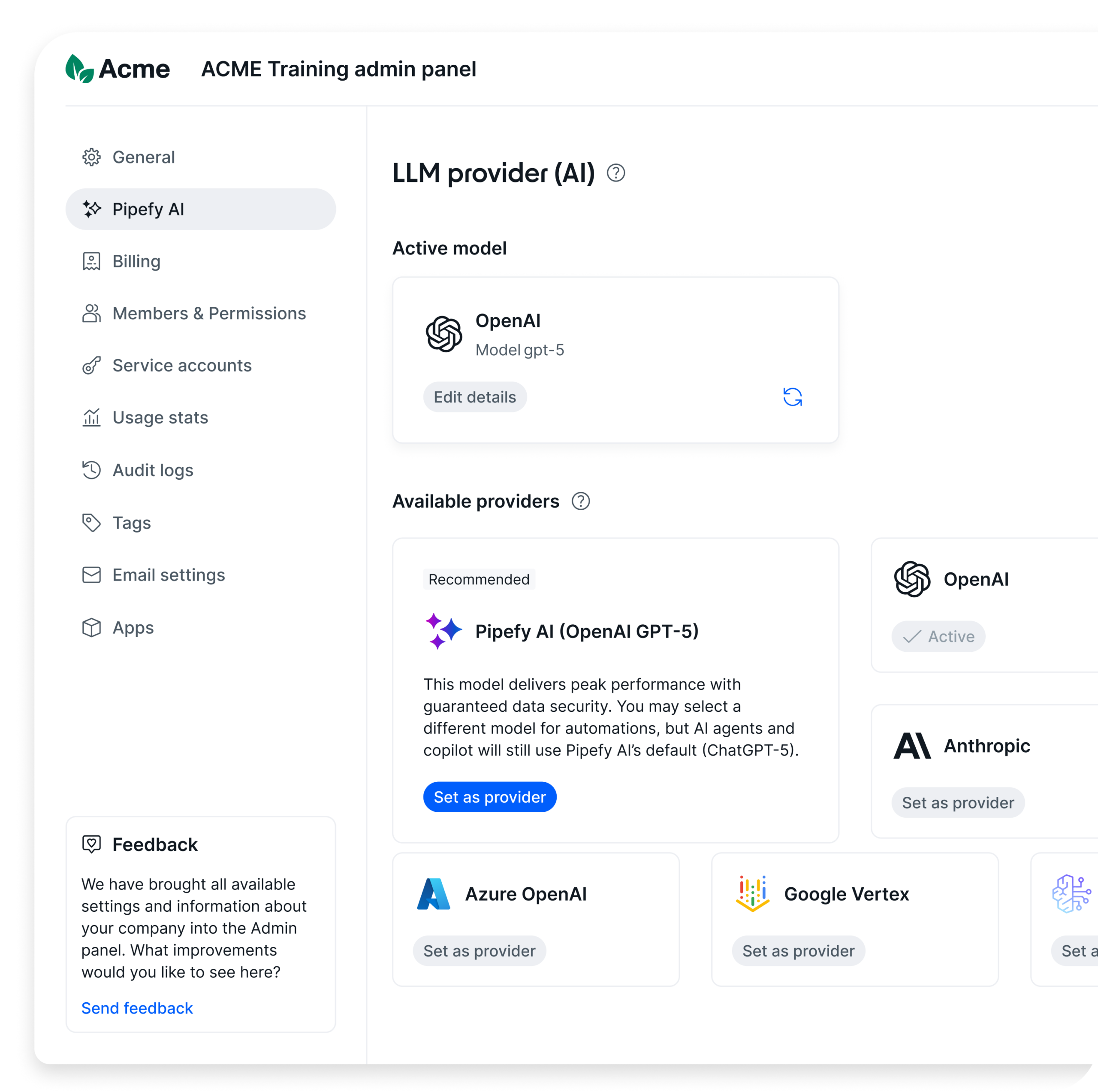

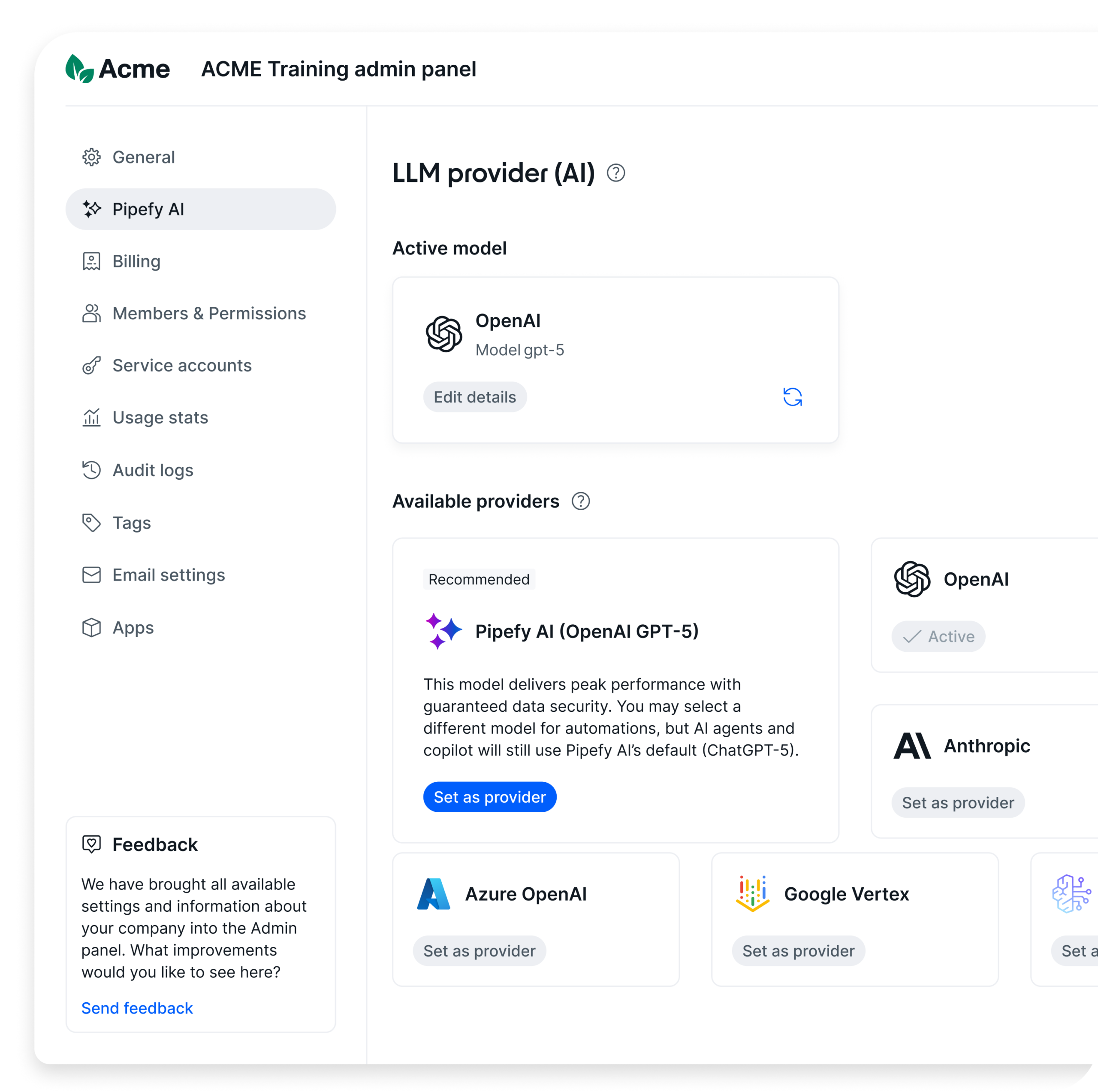

Pipefy is the only platform that combines process automation with integrated governance and enterprise-grade security, providing compliance by design, full auditability, and precise control over AI and sensitive data.

SOC1, SOC2, ISO 42001 and ISP 27001 + ISOS Compliance

With no-code workflows and AI Agents, companies accelerated operations, reduced costs, and gained more freedom so teams can focus on what really matters.

If you need help, we’re here to guide and support you.

Only Pipefy combines simple setup, hundreds of integrations, governance certifications, and an incredible user experience for your teams—without overloading your technical staff.