Pain points

Manual checks and rework between teams.

Automated Activities

Compliance AI, Legal AI, Identity Validation AI, and Credit AI validate individual and business data with external sources (IRS/Tax Authority, Serasa, BigDataCorp).

From identity checks to credit decisioning, each agent supports a phase of the process to ensure speed, compliance, and unbiased decisions.

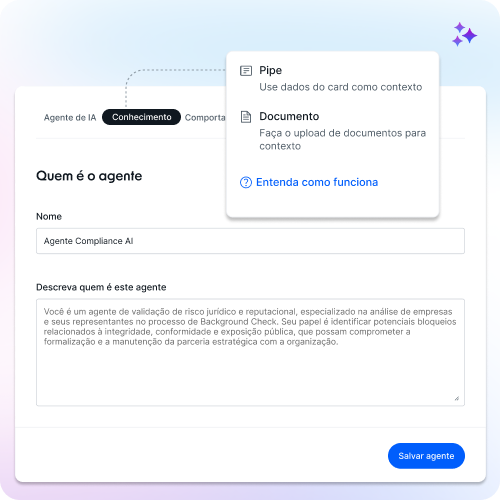

Runs automated compliance checks, PEP screening, and restricted lists for individuals and businesses.

Automated Activities:

• Queries public and private sanctions and PEP databases.

• Cross-checks information with bureaus (UN, Central Bank, Serasa, BigDataCorp).

• Applies internal compliance and privacy policies.

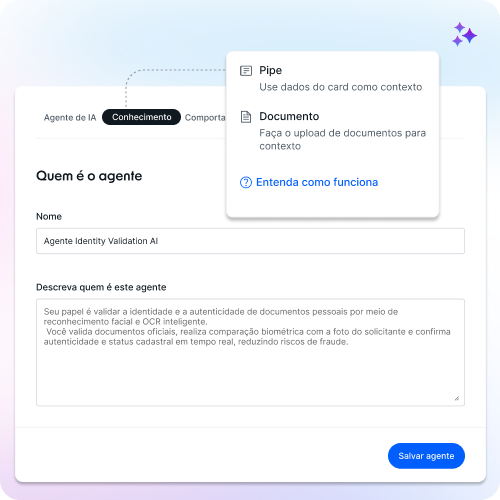

Validates identity and document authenticity via facial recognition and OCR.

Automated Activities:

• Validates documents with smart OCR.

• Performs biometric comparison with the applicant’s photo.

• Confirms authenticity and registration status in real time.

Validates identity and document authenticity via facial recognition and OCR.

Automated Activities:

• Validates documents with smart OCR.

• Performs biometric comparison with the applicant’s photo.

• Confirms authenticity and registration status in real time.

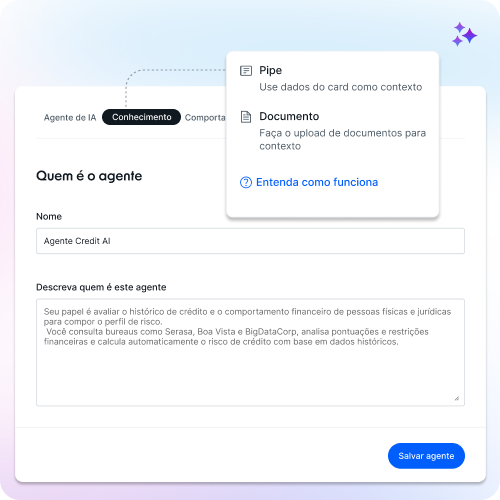

Evaluates the credit history and financial behavior of individuals and businesses.

Automated Activities:

• Queries bureaus (Serasa, Boa Vista, BigDataCorp).

• Analyzes scores and financial restrictions.

• Calculates credit risk based on historical data.

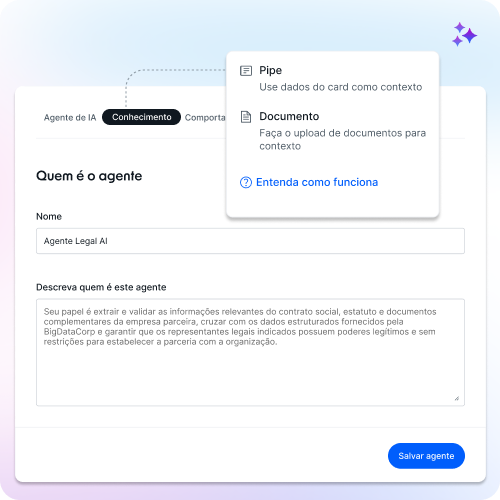

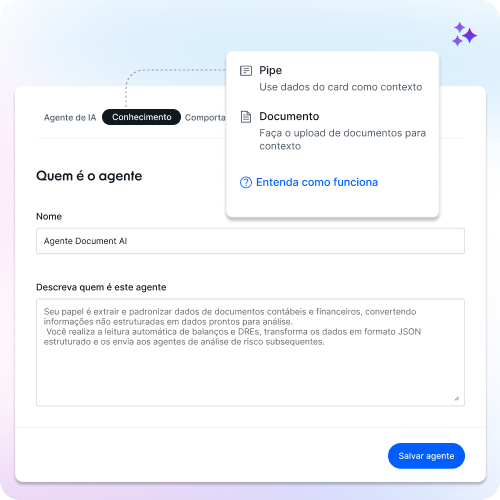

Extracts and standardizes data from accounting and financial documents, converting them into a structured format.

Automated Activities:

• Automatically reads balance sheets and income statements.

• Converts data into structured JSON.

• Sends outputs to risk analysis agents.

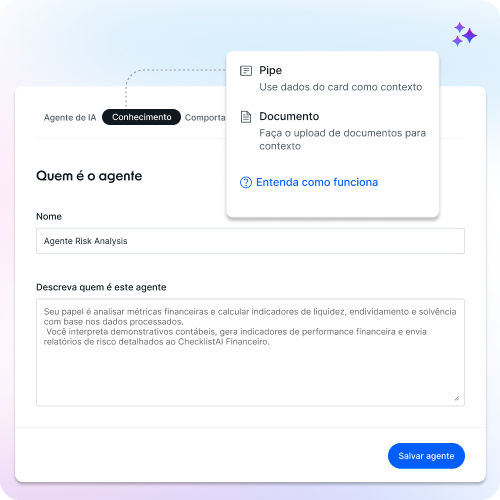

Analyzes financial metrics and calculates liquidity, leverage, and solvency indicators.

Automated Activities:

• Interprets accounting data.

• Generates financial performance indicators.

• Sends risk reports to the Financial Checklist AI.

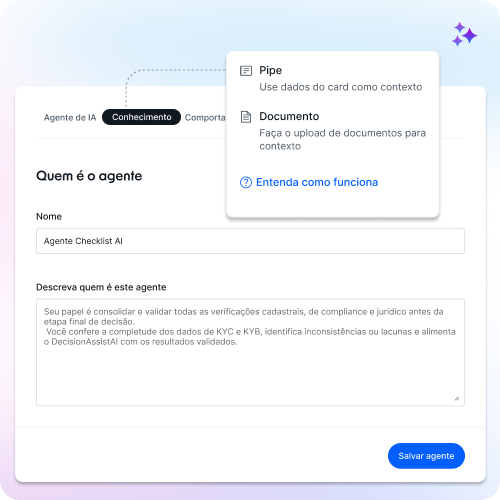

Consolidates and validates all identity, compliance, and legal checks before the final analysis.

Automated Activities:

• Verifies completeness of KYC/KYB data.

• Identifies inconsistencies and gaps.

• Feeds validated results into Decision Assist AI.

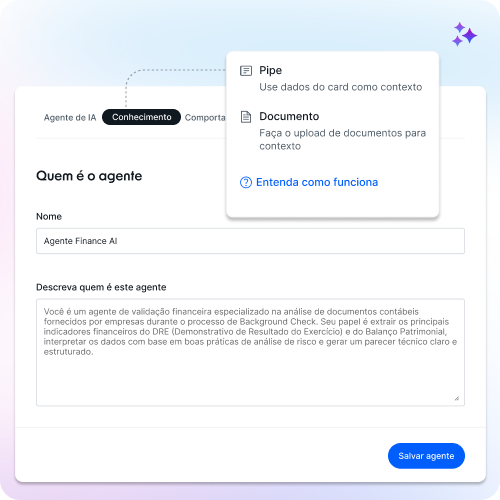

Ensures the integrity and consistency of financial and accounting information before the final decision.

Automated Activities:

• Validates submission of documents and statements.

• Checks consistency between tax and financial data.

• Sends the consolidated assessment to Decision Assist AI.

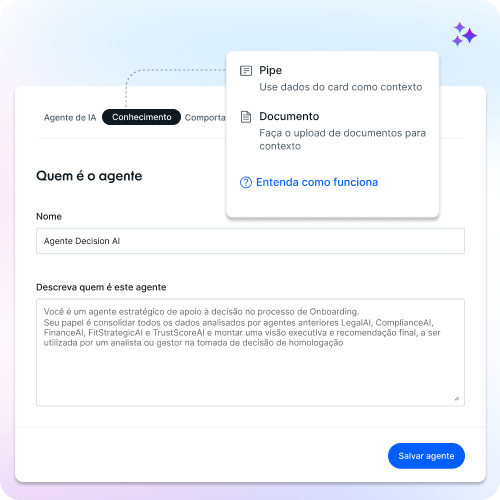

Consolidates all outputs from prior agents, applies credit policies, and issues the final decision.

Automated Activities:

• Analyzes compliance, legal, and financial information.

• Applies internal policies and approval criteria.

• Generates an automated outcome (approve, review, or decline).

SLA reduced from 36 days to 2 days, with end-to-end automation across the pipeline.

Automation removed rework and accelerated approvals across stages.

Lower administrative costs and higher productivity per credit team.

Learn hands-on how to build, automate, and scale end-to-end processes in Pipefy Academy.

Create forms and portals to centralize requests. Structure pipes and cards to track work with clarity and control.

Build custom databases and keep your team’s data always up to date and connected.

Eliminate manual tasks with automations, AI agents, and email tools that work for you.

Create reports, interfaces, and dashboards to visualize metrics, spot bottlenecks, and make data-driven decisions.

Learn to use Pipefy strategically, build your first agent from scratch, and gain autonomy to scale your workflows—and keep scaling with confidence.

Access the courseJoin conversations, share best practices, and discover new ways to power up your processes.

Access Pipefy CommunityIf you need help, we’re here to guide you and provide full support.

Pipefy is one of the market’s most respected platforms, recognized by leaders for its innovation, robustness, and operational impact.

Only Pipefy combines simple setup, hundreds of integrations, governance certifications, and an incredible user experience for your teams—without overloading the technical staff.