In today’s insurance landscape, Mid-Tier carriers face mounting pressure to compete with digital-first giants and meet rising customer expectations. At the heart of this transformation lies a critical decision: build or buy an underwriting workbench enabled by low-code technology?

This article explores the pros and cons of both approaches in the context of low-code underwriting, empowering insurers with the clarity to choose the best path. From Business Process Automation (BPA) and BPM to AI Agents and agentic workflows, the right choice can dramatically impact cost, time-to-market, and operational efficiency.

Why low-code underwriting matters now

The underwriting process has long been the backbone of insurance operations—but also a source of operational drag. Traditional systems are often siloed, difficult to change, and expensive to maintain. Low-code underwriting platforms allow insurers to automate, customize, and evolve faster.

With low-code, Mid-Tier carriers gain:

- Agility to respond to market shifts.

- Customizable workflows with fewer dependencies on IT.

- Accelerated product development cycles.

- Integration with AI Agents for intelligent task automation.

When embedded in an underwriting workbench, low-code empowers insurers to reduce time-to-quote, ensure compliance, and scale faster—without complex code.

Build vs. Buy: strategic considerations for Insurers

Building In-House: Full Control, but at What Cost?

Opting to build your own low-code underwriting workbench provides control and customization. However, the reality for Mid-Tier carriers often involves:

- High upfront investment in development teams and infrastructure.

- 12–18 months of implementation time, depending on scope.

- Ongoing maintenance and upgrades requiring technical resources.

- Greater risk of delays and integration issues.

“In-house builds are rarely cost-effective unless you have significant internal engineering capacity and underwriting-specific expertise.”

Buying a platform like Pipefy: ready to scale and AI-Enabled

On the other hand, adopting a proven low-code platform like Pipefy delivers:

- Quick implementation (as little as 2–4 weeks).

- A cost-effective SaaS model with predictable pricing.

- Built-in BPA, BPM, and AI Agents capabilities.

- Seamless integration with legacy systems via APIs and no-code connectors.

- Continuous updates and improvements—no maintenance burden.

Pipefy empowers underwriters to orchestrate complex decisions with agentic workflows, customize processes visually, and embed intelligent automation with minimal IT support.

Read more: Digital insurance with AI: how technology is transforming the customer experience

Cost & Time comparison: build vs. buy

| Criteria | Build In-House | Buy Pipefy |

| Time to Deploy | 12–18 months | 2–4 weeks |

| Initial Cost | $250,000+ | From $30,000/year |

| Maintenance | High (in-house devs) | Included |

| IT Involvement | High | Low |

| AI Capabilities | Must be built separately | Native with AI Agents |

| Upgrades | Manual | Automatic |

| Compliance Support | Custom-coded | Embedded workflows |

| Flexibility | High (if resourced) | High (with low-code control) |

Insight: For most Mid-Tier carriers, the “build” option only makes sense with extensive in-house resources and a long runway. Otherwise, Pipefy’s ready-to-deploy, enterprise-grade solution significantly lowers risk and accelerates ROI.

What sets Pipefy apart in Low-Code underwriting

Pipefy is more than a low-code platform—it’s a strategic enabler for insurers seeking agility and intelligence.

1. AI-Enabled Workflows with AI Agents

Pipefy enables underwriters to delegate repetitive tasks to AI Agents, such as:

- Document classification

- Risk scoring pre-analysis

- Pattern detection that may indicate fraud

This reduces human error and speeds up quote-to-bind cycles, giving your team more time for strategic decisions.

2. Agentic Workflows

Combine AI Agents, BPA, and human oversight in orchestrated agentic workflows. Underwriters get automated data collection and validation, followed by alerts or approvals only when needed. That’s operational efficiency at scale.

3. Embedded BPA & BPM Capabilities

Pipefy has native BPA and BPM functionality:

- Drag-and-drop automation rules

- SLA tracking and escalation workflows

- End-to-end process visibility

It’s ideal for carriers that want control without complexity.

4. Designed for Non-Technical Users

Pipefy democratizes automation. Business users configure workflows without writing a single line of code, reducing reliance on IT and speeding up innovation cycles.

Read more: No-code AI Agents Development: What Your Company Needs to Know

Real-World scenarios: Pipefy in action

Mid-Tier Carrier A reduced underwriting cycle time by 42% by implementing Pipefy’s pre-built underwriting workflows with document AI and SLA alerts.

Carrier B used Pipefy’s low-code interface to integrate CRM, claims, and risk data into one centralized view, enabling faster risk decisions and cross-department collaboration.

Both saw results within 90 days—and continued to scale with minimal support.

Why Buying Makes Sense for Mid-Tier Carriers

The days of long implementation cycles and static software are gone. Mid-Tier carriers must move quickly, scale smartly, and stay adaptable.

Choosing to buy a platform like Pipefy for your low-code underwriting needs allows you to:

- Gain rapid time-to-value

- Leverage proven AI-powered automation

- Empower business users

- Reduce IT overhead

- Improve underwriting precision and agility

Pipefy is designed with insurance-specific use cases in mind—ready to implement and scale, but flexible enough to evolve with your business.

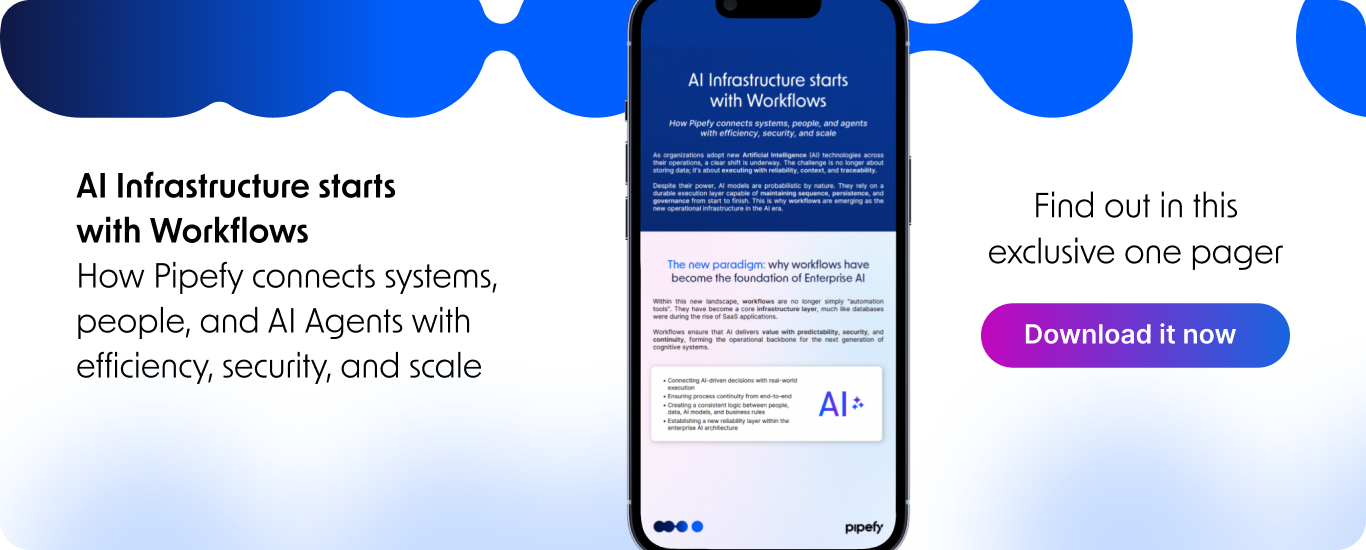

Ready to Take the Next Step?

Want to see how Pipefy can help your team build a scalable, intelligent low-code underwriting solution in weeks—not months?

Press the button below to access a live demo and experience the future of underwriting.

Frequently Asked Questions (FAQ): low-code underwriting in the insurance market scenario

What is low-code underwriting?

Low-code underwriting uses visual interfaces and drag-and-drop logic to configure and automate underwriting processes. It reduces the need for traditional coding and enables faster process customization, especially for carriers with limited IT resources.

How can AI Agents enhance underwriting?

AI Agents can automate document analysis, flag inconsistencies, and provide risk insights. When embedded in low-code platforms, they deliver intelligent automation with human-in-the-loop flexibility.

Is low-code secure enough for insurance workflows?

Yes. Mature low-code platforms like Pipefy offer enterprise-grade security, compliance with data regulations (e.g., GDPR), and audit trails that meet the standards of modern insurance governance.

Can Mid-Tier carriers customize Pipefy’s solution?

Absolutely. Pipefy is built for flexibility. Teams can adapt forms, rules, integrations, and dashboards to their underwriting logic without technical complexity.

What’s the difference between BPA, BPM, and agentic workflows?

- BPA (Business Process Automation): Automates repeatable tasks.

- BPM (Business Process Management): Orchestrates end-to-end workflows.

- Agentic workflows: Combine AI Agents, human input, and automation logic for dynamic, intelligent decisioning.

Pipefy supports all three—natively.