Key takeaways

- The invoice processing activities can be tedious, time-consuming, and costly — especially processed manually across siloed systems, disparate legacy solutions, and disconnected processes.

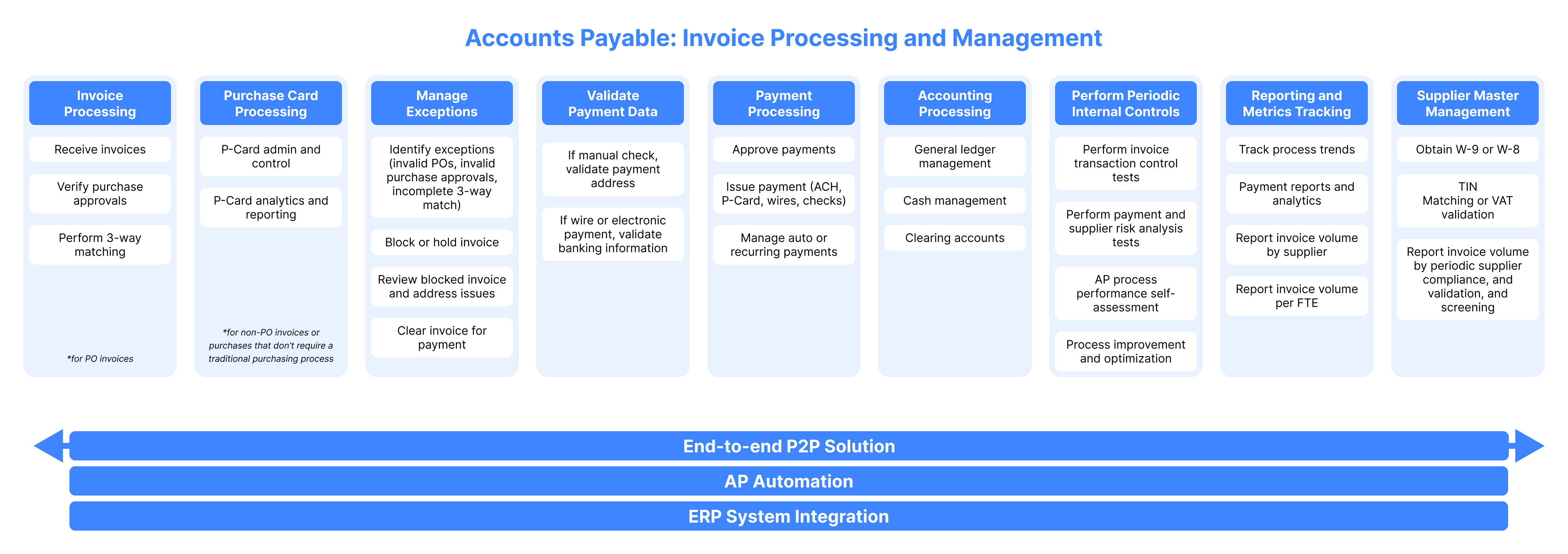

- Because the accounts payable process is significantly influenced by other moving parts within the procure-to-pay (P2P) process, it’s critical that businesses take on a more thorough P2P solution to achieve end-to-end invoice processing automation and efficiency.

- With a P2P solution that automates invoice processing, invoice processing activities can be streamlined and even improved for higher processing accuracy and faster payment cycles.

Definitive Guide to P2P OptimizationDownload now

What is automated invoice processing?

Invoices are documents generated and issued by suppliers that indicate the products, product quantities, and pricing for products and services provided by them to a business, either via email, mail, or electronically. While the primary use for invoices is to ensure suppliers and vendors get paid for their products or services, they also serve other important functions for those that receive them.

The information listed in invoices helps the accounts payable team keep track of company spending and purchase trends to better predict needs, which in turn improves the purchasing team’s sourcing and strengthens negotiation power. However, manual invoice processing is usually time-consuming, costly, and error-prone.

Automated invoice processing simplifies end-to-end invoice processing activities by eliminating the time and costs associated with manually processing invoices. Because invoice processing is part of the larger accounts payable process, automated invoice processing is usually the outcome of a larger accounts payable automation initiative.

In “The New Accounts Payable Toolkit,” author Christine H. Doxey defines AP automation as “the solutions and services which automate the people- and paper-based processing invoices for approval and posting into the accounting system.”

Automated invoice processing makes it easy to process both types of invoices: those connected to a purchase order (known as a PO-based invoice) and those that are not connected to a purchase request or purchase order (known as a non-PO invoice).

Factors driving invoice processing automation

According to Doxey, the adoption of invoice processing automation is no longer just about improving efficiency. It’s now a matter of unlocking strategic and tactical benefits like spend visibility, forecasting accuracy, cash management, and improved supplier relationships — all valuable drivers following recent economic and supply chain disruptions.

Of the many factors driving invoice processing automation, there are a few that stand out for both buyers and suppliers, such as:

- Better liquidity and cash management control

- Access to key process data to drive more effective decision making

- Faster payment cycles

- Lower e-invoice software implementation costs

- Latest functionality and usability with the least IT burden for higher widespread adoption

- Centralized and enhanced workflow functionality for seamless document and information flow

What is an automated invoice system?

An automated invoice system integrates your existing accounting system with your invoice approval workflow, which is a part of the larger accounts payable or P2P process.

In addition to creating a seamless exchange of information, an automated invoice system also centralizes documents and automatically performs document matching between purchase orders, receipts of goods, and invoices.

With the help of an automated invoice system, AP teams can also streamline invoice processing steps like:

- Verifying approvals against policies

- Validating banking information (or delivery address for paper-based payments)

- Routing approvals to the right people on time, every time

- Performing internal controls like supplier and payment risk tests

- Reporting and measuring metrics or process analytics

Benefits of invoice processing automation

The key benefits of invoice processing automation are speed, accuracy, and cost savings. Here’s a breakdown of what goes into unlocking those benefits and achieving better accounts payable (and P2P) results.

Less manual data entry

Manual data entry is not only a time concern, it’s a risk concern. Because humans are entering and transferring data manually, human errors can occur and result in larger risks like overpayment or underpayment.

By eliminating manual data entry, teams can ensure that the information being processed is accurate and aligns with all the documentation on file, such as purchase orders and receipts for goods.

No more managing email threads or spreadsheet sprawl

Another time-consuming activity that can creep into the accounts payable process is disconnected communication and information. Whether it’s communication between requesters, suppliers, vendors, or internal teams, keeping up with all the information shared and received across multiple sources of information limits visibility, efficiency, and collaboration.

With an automation system that centralizes information and automates communication, teams can reinvest that time into more strategic activities.

Lower invoice processing costs and time

There are many hidden costs associated with manually processing invoices. Ardent Partner’s 2022 The State of ePayables study reports that high invoice processing costs were among the top challenges AP teams faced in 2022.

The same study found that the average total, all-inclusive cost of processing a single invoice is $10.18 and takes an average of 10.9 days to complete. However, additional reports price this as high as $15 to $40 per invoice and as many as 45 days to process if done manually. This total all-inclusive cost can include:

- Labor costs

- Full cost of running your AP department

- Time spent reviewing invoices

- Time spent identifying and correcting data entry errors or duplicate payments

- Cost of archiving and storing physical invoices

- Discounts lost or incurred penalties due to late payments or errors

- Time spent by the AP team performing invoicing duties rather than their assigned functions, like chasing after missing information

But by introducing levels of automation to the accounts payable process, invoice processing costs can be reduced and efficiency can be increased. To illustrate the impact of automation, consider these numbers from a 2021 report by the Institute of Finance and Management:

Total cost to process invoices

| AP process maturity | No automation* | Limited or low automation* | Significant automation* | End-to-end automation* |

|---|---|---|---|---|

| Desk level | $6.30 | $2.81 | $2.80 | $3.03 |

| Department level | $3.31 | $2.72 | $2.71 | $2.68 |

| P2P level | $1.83 | $1.64 | $1.57 | $1.45 |

| *Automation levels based on how many of these steps are automation: invoice receipt, data capture, invoice approval, 3-way matching, and making payments No automation = 0 steps automated / Limited or low automation = 2 steps automated / Significant automation = 3 steps automated / End-to-end automation = 4+ steps automated |

Unlocking stack extensibility

Implementing a new solution can become a time-consuming process that can turn an already complicated manual process into a bigger pain to manage. But with an automation solution that seamlessly and easily integrates with your existing invoice processing system or back-end system, AP teams can unlock something known as stack extensibility.

Stack extensibility expands the capabilities of existing tech solutions and bridges the gap between what the existing tech stack can do and what it should do.

Reduced fraud risks

According to a 2020 report by the Association of Fraud Examiners, it’s estimated that organizations lose up to 5% of revenue due to fraud each year. However, a fraud scheme can take as many as 14 months before it’s detected. Common forms of fraud include:

- Billing fraud

- Check fraud

- Payment fraud

- Financial statement fraud (this specific type reported a median loss of $945,000)

So of the many benefits of invoice processing automation, establishing controls to get ahead of potential fraud and losses is one of the most valuable.

Better invoice organization and archiving

A digital invoice processing system means less paper-based processing, which means less paper to organize and keep track of. By digitizing and automating the accounts payable process (and larger procure-to-pay process), invoice processing becomes faster, more accurate, more efficient, and more secure.

How to automate invoice processing: 7 steps for a successful implementation

Whether you’re just getting started on your automation journey or are interested in implementing additional layers of automation to your manual accounts payable process, here are seven steps to help you stay organized and automate your manual invoice processing successfully.

Or, if you’re not ready to start automating now, check out these helpful articles on workflow automation and accounts payable automation to learn more about the benefits of automation and what to look for in an automation software system.

Step 1: Define what you want to achieve (and automate)

First things first: strategy. Before you start automating your invoice processing activities, it’s important to define what you want to achieve and why you want to achieve it, whether it’s faster approval cycles, making earlier payments, approval handoffs, or eliminating manual activities like status updates, data entry, or approver notifications.

This not only sets the tone for your automation process, but it also helps keep you and your team aligned with the greater goal. With a defined purpose, every update you make to your process has a reference point to ladder back up to ensure you’re on the right track.

Step 2: Establish KPIs or metrics

In addition to defining your to-be workflow, consider defining key invoice receipt-to-pay metrics to help analyze the performance and success of your newly automated workflow. Plus, it will make it easier to track how your AP team performs, stay on top of quality control, and manage both PO invoices and non-PO invoices.

While this may vary depending on your goals, here are a couple of KPIs or metrics to consider to compare your manual invoice processing before and after automation:

- Total invoices pending approval

- Past due invoices

- Past due invoices per approver

- Average approval or turnaround time

- Average total invoice processing time

- Number of invoices that required additional follow-ups during the approval phase

- Late fees incurred (in total and per invoice)

- Cost to process per invoice

Step 3: Assess and map your current invoice processing workflow

With your goal defined and in mind, it’s time to assess your as-is process. In order to understand how to improve your process with automation, you first have to take a step back and view the workflow from a bird’s eye view. Start by mapping your current workflow and detailing the elements that shape it. This includes:

- The start or trigger event that kicks off the workflow

- The workflow’s end result

- The actors involved

- The work that is being done

- The information needed to complete or inform the work

- The systems, databases, existing software, or applications that hold or impact the work

In this case, an example of those elements would be:

- Trigger event: The receipt of goods or services rendered

- End result: Payment is issued to suppliers or vendors

- Actors: Accounts payable, approvers, suppliers, requesters

- Work: Assigning approvers, requesting approvals, reviewing and 3-way matching invoices, updating accounting records, validating payment information, issuing payments, updating suppliers on the status of payment, contacting suppliers or purchasing team in case of missing information, handoffs between teams and actors

- Information: Purchase orders, receipt of goods, invoices, banking information, supplier information

- Systems: Existing accounting software, connected processes or workflows, supplier databases

In addition to mapping your current workflow, be sure to also document this information and create a record of both the as-is workflow and its elements to refer back to.

Step 4: Map out your desired, automated workflow

Now that you have a wider view of your current invoice processing workflow and its inner workings, it’s time to start mapping out how you’d like it to function. Here you can begin to define what steps you’d like to automate in further detail.

Below is a list of tasks that can be automated to improve the efficiency of your invoice processing:

- Invoice matching

- Submitting matched invoices for approval

- Routing invoices to the right approvers

- Centralizing records and communication

- Approval request notifications

- Approval status update requests

- Defined deadlines and alerts to ensure payments are issued on time

- Payment status updates to suppliers

- Validating payment information

- Ledger coding

- Updating balance sheet

- Measuring process and AP performance

- Document centralization

- Manual data entry

Step 5: Configure your automations

With your goals, automation “wish list,” and to-be workflow ready, it’s time to bring your automations to life. Your automation software or system will make planning and configuring easy, especially if you’ve opted for a solution with a no-code framework.

Learn more about the benefits of no-code automation software.

Step 6: Communicate new policies, procedures, and internal controls

This is where your documentation of previous steps comes in handy. In addition to automating your invoice processing workflow, you’ll also have to communicate the updates with relevant internal and external stakeholders.

For example, if you’ve automated a payment status update email with an email template, be sure to let suppliers or vendors know of this new form of communication.

Or, if an additional step has been added to the approval cycle, let relevant approvers know about the addition, why it was added, and how it will impact approval requests. As always, be sure to document this information as well so that you can easily share and update it.

Step 7: Launch, monitor, and continuously optimize your new workflow

Once you’ve deployed your automations and communicated the updates to the workflow and accounts payable process with your team and relevant stakeholders, monitor your updates and track the KPIs and metrics you defined during Step 2 by building a customized dashboard for real-time analytics.

Depending on your automation software, creating dashboards to automatically track this information and generate regular and standardized or ad hoc reports are made easy with dashboard templates or customizable dashboard capabilities.

With the process insights provided by your dashboard, you can measure whether your invoice processing has become more accurate and efficient post-automation and make the changes you need to continuously optimize and improve your automated invoice processing.

Invoice management made better with Pipefy

According to Amazon Business’ 2022 State of Business Procurement Report, 55% of B2B buyers plan to invest in procurement technology over the next five years to digitalize invoices and move away from manual invoice processing. These investments will be made to help resolve many of the day-to-day purchasing and AP pain points, including:

- Complex approval processes

- Too much time reconciling invoice

Because the accounts payable process is significantly influenced by other moving parts within the P2P process, it’s critical that businesses take on a more thorough P2P solution to achieve end-to-end invoice processing automation and efficiency.

With a P2P solution like Pipefy, procurement teams can centralize the end-to-end P2P process, streamline the purchasing process, automate the full accounts payable process, improve compliance and spend tracking, reduce errors or delays between process and task handoffs, and lower the time (and cost) associated with processing invoices.

Plus, Pipefy’s no-code framework makes it easy to plan and implement automations quickly without tapping into IT resources.

Centralize requests, documents, and information, eliminate manual invoice processing and information matching, and improve user experiences for all stakeholders for faster approvals and payment cycles. By integrating Pipefy with your existing account stack, there’s no more back and forth through ERP, emails, e-procurement, and accounting systems which means no more wasting time manually managing information, communication, or processing invoices.