ARTICLE SUMMARY

You've probably heard about it more than once, but do you actually know what is Accounts Receivable? Well, you should, it's a pretty big deal!

Accounts receivable is the department responsible for collecting incoming cash for your business, which makes it a very important finance process. In fact, your accounts receivable can even influence your organization’s ability to get a loan (something called receivable financing).

In this article we will talk about some of the typical terms you may hear around accounts receivable, including a little bit of bookkeeping 101, talk about typical payment terms and what it can mean for managing your unpaid invoices and current liabilities, and help you, as a business owner, maintain a happy balance sheet.

Definitive Guide to Workflow ManagementDownload guide

What is accounts receivable?

Accounts receivable is an asset account on your balance sheet that literally means money that has not yet been received, such as something bought on credit or something that is billed, basically any payment method except cash. You’ve probably used accounts receivable without even realizing it before. If you work a job that earns a paycheck, then that is an example of expecting to be paid for your services, just as a business expects to be paid for the goods and services they provide. It’s a lot simpler when you think of it in these terms.

So why does it matter if you have an accounts receivable department handling your payments? Well, in this day and age, most people carry more plastic than cash and rely heavily on credit systems. It’s also important to understand that while accounts receivable isn’t tangible cash yet, it will be once the collection is made. This is an example of cash flow, and having a steady cash flow means you are making sales and your business is receiving profits.

For example, if you sell a product, your money went into making that product and distributing it. You sell it for a higher amount than you put into it. You receive this money from the distribution of the product and can then divide the profit into payroll and investment in more products to sell. The cash flows from you to the buyer and back to you again in a cycle. This is a sign of a healthy business.

You may be wondering, “Doesn’t an intangible payment like accounts receivable put the company at risk of not getting paid?” Well, there are certainly risks just like any business endeavor, but accounts receivable are guaranteed since there is a legal obligation for the money to be paid to you. If payment is not made, you can take the matter to court to settle the balance due. So do not think of accounts receivable as a form of bad debt.

Bookkeeping 101

When you look at your organization’s balance sheet, one of the items that you will find is accounts receivable. Your books will show any accounts receivable as a current asset that is due in the calendar or fiscal year. In your company’s balance sheet, you’ll have a record of your accounts receivable and as a customer pays against their account, you will note the amount of money they paid. If it sounds very similar to balancing your checkbook, well, it is. When an organization is looking at its balance sheet, it is common to notate both accounts receivable as well as doubtful accounts. Accounts that may reflect on the total amount of accounts but are likely to be difficult to collect.

Payment terms

Payment terms are often described as net 30 or net 60, where the number indicates the amount of time (in days) the account has to make payment for the services or goods you provided (commonly called the due date). For an outstanding invoice that falls outside the period of time indicated in the payment terms, the next step is often referring to the unpaid invoice to a collection agency to attempt to collect the debt. Oftentimes, to help avoid going down the collection agency route, organizations will offer discounts for early payment.

For a small business, turning to a collection agency can be an expensive prospect, so it is common to utilize late fees as a means to encourage debtors to pay on time. For some unpaid debts, it can be possible to write off that bad debt so consulting an accountant on these types of accounts may be a good idea.

Managing liabilities

Managing liabilities in your company’s balance sheet can be a tricky proposition. It is often helpful to assess the number of accounts, the line of credit each debtor has (factoring in the accounts’ overall size), and look at how these accounts are impacting you in both the short-term and long-term. One common way to look at managing your liabilities is looking at your accounts receivable turnover ratio, which is basically how many of your accounts receivable are paid in full.

By keeping a healthy account receivable turnover ratio you can ensure your company maintains a proper level of liquidity and keeps your financial statements in a good place and your organization with enough working capital to keep moving your organization forward. Plus having a picture of the average accounts receivable (as well as the average accounts receivable balance) your business carries will help you prepare for the future and alert you if the ratio is getting too high.

Accounts payable vs. accounts receivable

It’s easy to think that accounts payable and accounts receivable are related, but they’re really not. In fact, accounts payable and accounts receivable are essentially opposites, just as the way debits and credits are. Accounts payable are the bills that your company needs to pay, whereas accounts receivable is money coming in (at least eventually). When you look at your overall income statement, you will of course have to factor in your accounts payable.

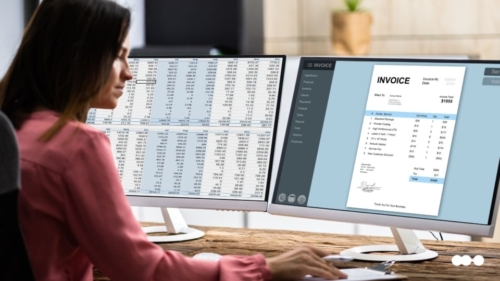

Manage your accounts receivable with Pipefy

Profits tied up in outstanding accounts receivable affect liquidity. So if all of this sounds complicated, the truth is that it can be. But having the right accounting system and accounting software can make a world of difference. That’s where Pipefy comes in.

Pipefy is a process automation and management software that simplifies and streamlines the ways teams track the status of each invoice.

With Pipefy, you can create an error-proof collections process built to automate even your most manually run and repetitive tasks. Pipefy frees up your teams to focus on identifying and resolving process constraints or bottlenecks, gain visibility and control over the collections process, reduce errors or delays, and maintain healthy cash flow for your business.