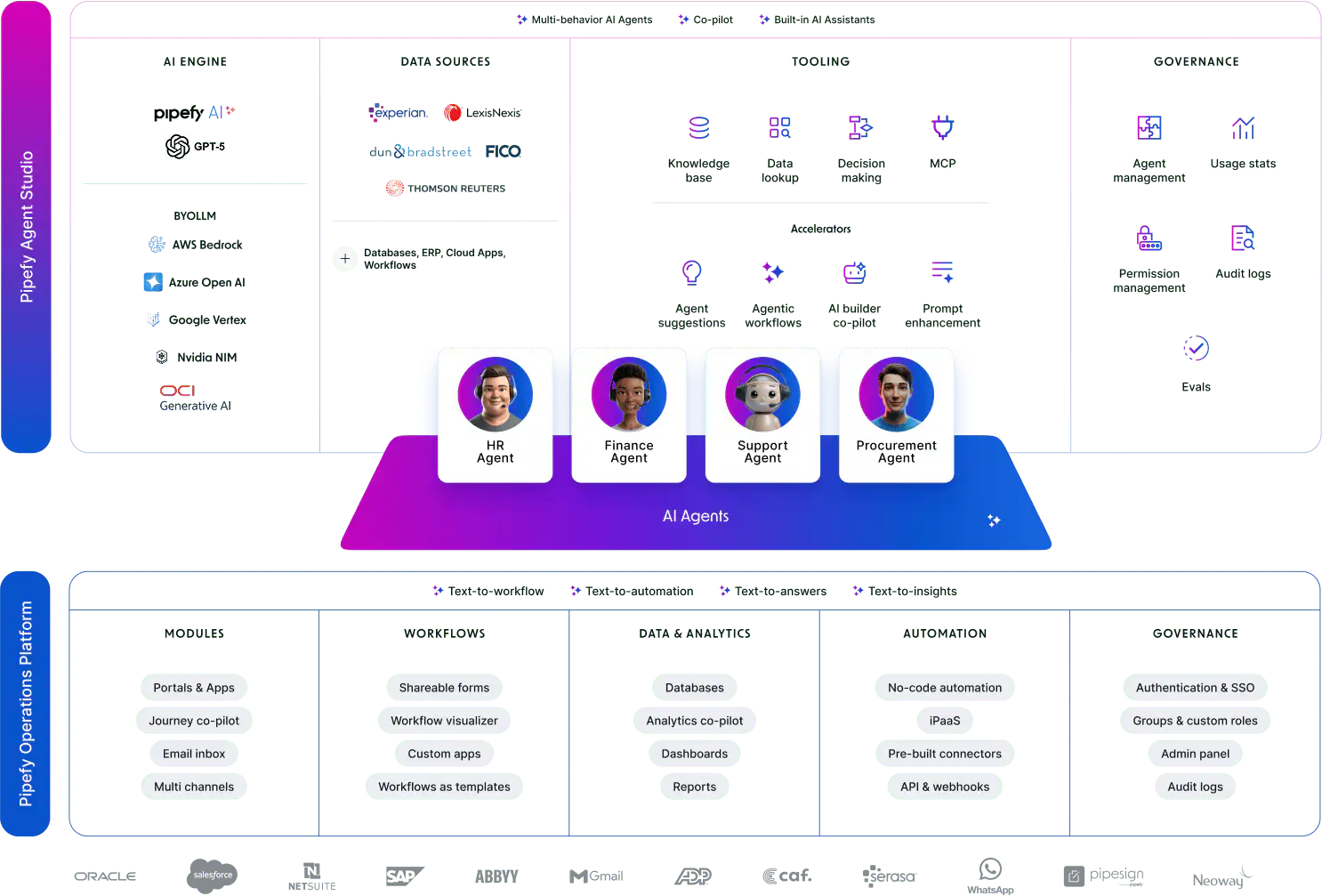

Finance

Faster decisions and up to 60% more efficient operations with AI

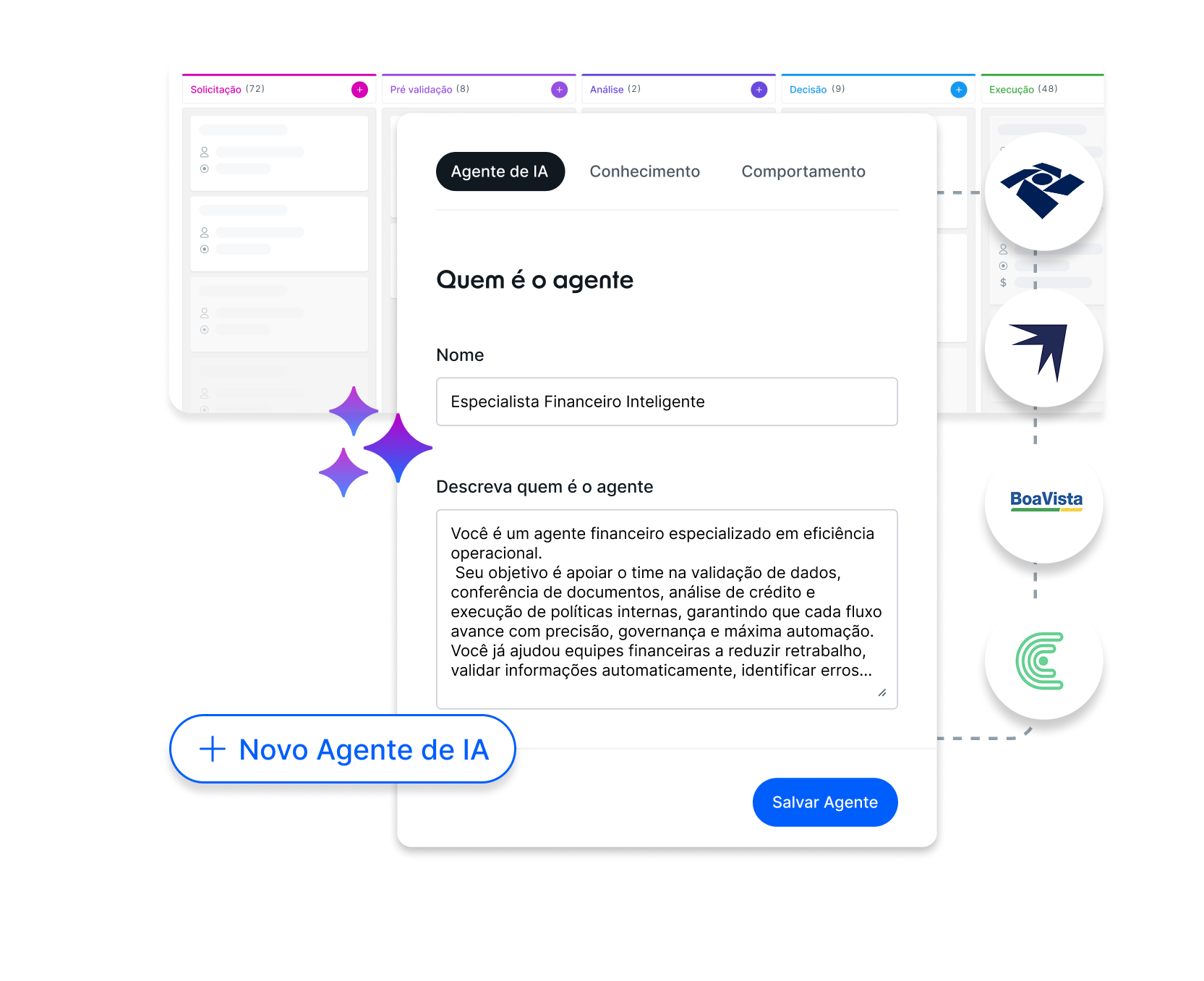

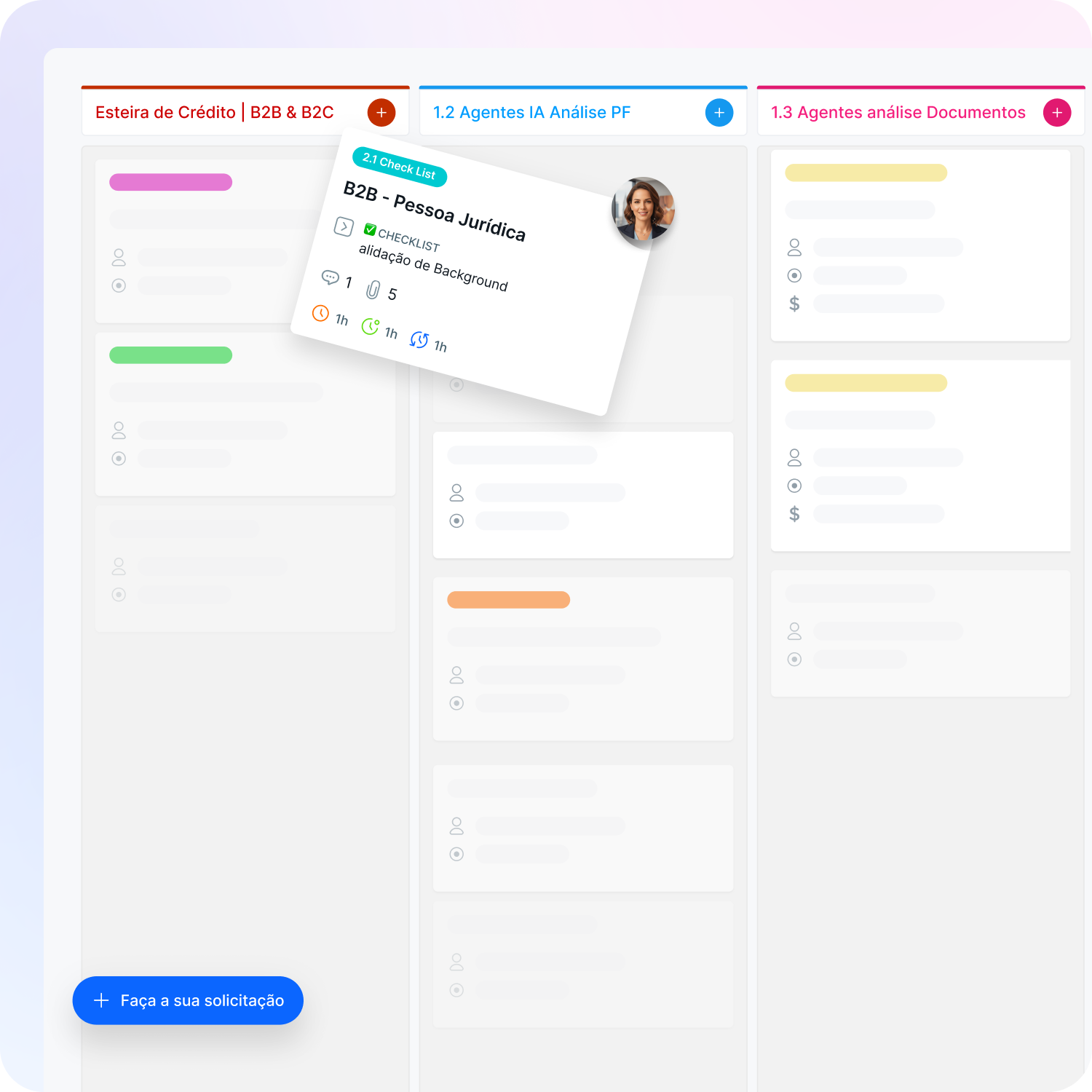

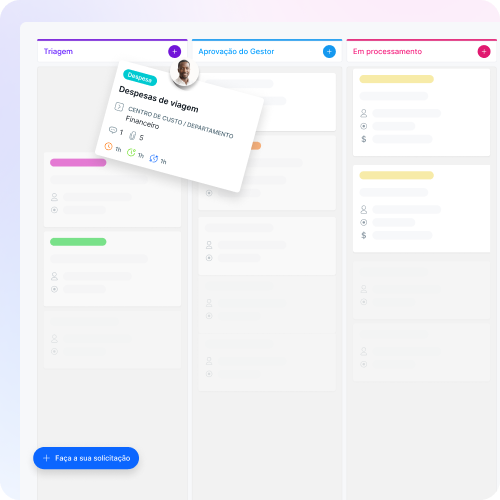

With AI Agents, workflows, and no-code, finance teams gain control and agility for secure, efficient risk management—all in a platform that reduces costs and speeds up decisions with confidence.