Accounts payable (also known as payables) represent a company’s short-term debts for goods, products, or services purchased on credit. Because these payables remain outstanding, they are marked as current liabilities on the balance sheet.

If payment is not issued according to the agreed-upon terms, payables go into default. If paid after the deadline, the purchasing company will likely incur penalties such as late fees or higher interest rates. In addition, the purchaser’s reputation as a reliable buyer may suffer. In some cases, vendors offer attractive discounts for prompt or early payments.

In this article, we’ll cover everything there is to know about accounts payable. We’ll take a close look at the accounts payable process, some of the common pain points and risks associated with AP, and some tools and strategies teams can use to solve them.

Definitive Guide to Workflow ManagementDownload guide

What does the accounts payable department do?

The accounts payable (AP) department plays a critical role in business strategy and operations. AP is the gatekeeper who ensures that payments are accurate, timely, and properly recorded. In addition, the AP team plays a key role in vendor relationship management.

In general, the AP department is responsible for the following:

- Three-way matching purchase orders, invoices, and receipt of goods

- Validating invoices

- Blocking invalid or fraudulent invoices

- Approving and issuing payments accurately and in a timely manner

- Accurately reflecting transactions in the general ledger

- AP reconciliation between accounts payable sub-ledger and general ledger

- Expense reporting

- Onboarding and setting up suppliers

AP departments that manage these tasks and workflows well can help the business achieve operational efficiency. Effective AP teams safeguard the business’ financial position, improve accounting and reporting, and maintain the company’s reputation as a desirable customer.

But when the AP department (and their processes) perform poorly, businesses may see a negative impact on their:

- Cash position

- Supplier relationships

- Credit worthiness

What is the accounts payable (AP) process?

The accounts payable process consists of a series of steps taken to process invoices and complete payments for purchases. The process is considered complete once a check or electronic payment is issued to the supplier by the agreed-upon due date.

Christine H. Doxey, author of “The New Accounts Payable Toolkit,” defines the accounts payable process as “a strategic, value-added accounting function that performs the primary non-payroll payment functions in an organization.” She also adds that this process plays a critical role in an organization’s financial cycle because it “enables an organization to accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of the entire payables process.”

The AP process may be performed by a single bookkeeper in a small business, a small AP staff in a medium-sized company, or an entire accounts payable department in a large organization. No matter who is responsible for the process, the key to successful accounts payable management is how well it’s structured. (More on this later).

Ultimately, the accounts payable process ensures that all payments issued are accurate, invoices are legitimate, discounts negotiated during the purchasing process are leveraged, and double or overpayments are prevented. It also makes financial auditing and accounting easier.

What is the full accounts payable cycle?

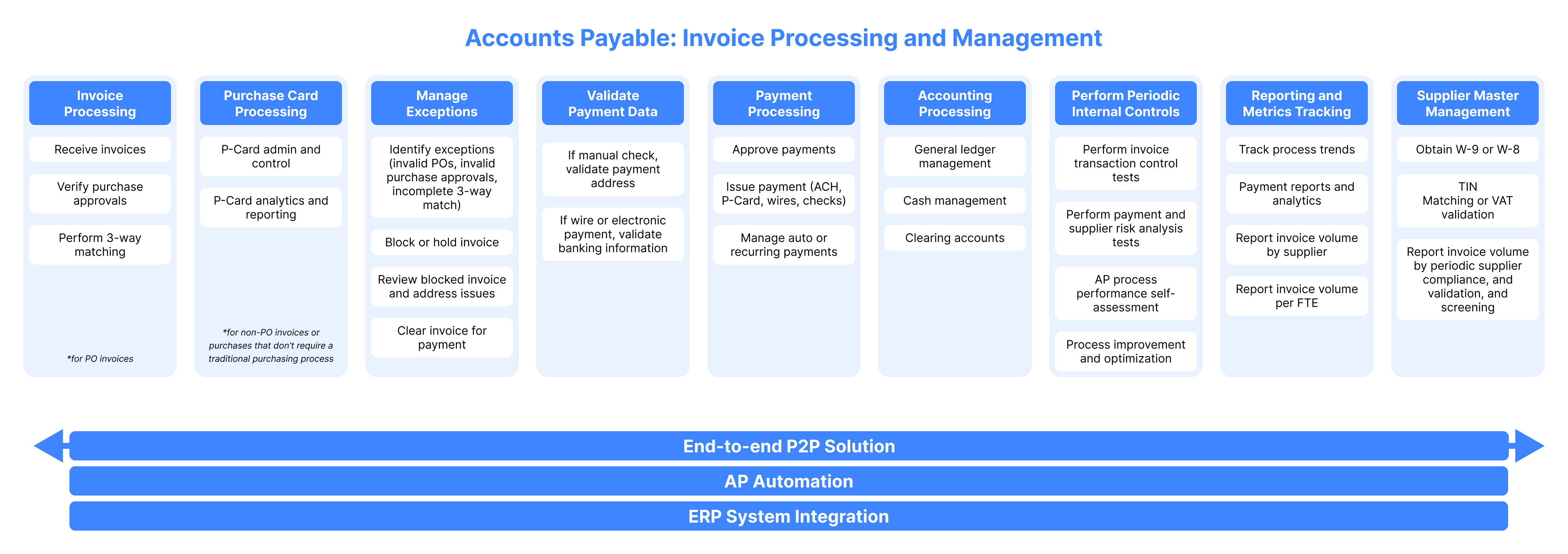

The full accounts payable cycle includes:

| Coding invoices with correct amounts, accounts, and company cost centers | 3-way matching invoice, receipt of goods, and purchase order | Approving invoices | Posting payment | Performing periodic internal controls |

But the accounts payable cycle doesn’t exist in a vacuum. The accounts payable process is one-half of procure-to-pay (P2P) cycle, which is the connection between the accounts payable process and the purchasing process within the broader procurement function.

The purchasing process is responsible for reviewing, approving, sourcing, and negotiating terms for purchase requests and issuing purchase orders, while the accounts payable process is responsible for receiving, reviewing, and matching invoices with purchase orders and issuing payments.

Because these two processes make up P2P, it’s crucial that they integrate seamlessly.

7 key benefits of a structured AP process

Like all teams, the AP department needs consistent, structured processes in order to avoid errors, maintain control and visibility of their work, and eliminate silos. A well-structured accounts payable process delivers many benefits for the business, but its capacity for cost containment is by far the most important. That’s because the accuracy and precision of the AP process have a direct impact on the business’ finances.

Beyond helping the business avoid unnecessary expenses, here are some of the other benefits of an optimized AP process:

1. Better spend visibility

AP teams are responsible for oversight of the company’s spend. An optimized, structured AP process includes clearly defined steps, standardized procedures, and centralized information. This makes it easier for AP teams to understand where the company’s money is going.

2. Less time spent in emails and spreadsheets

Unstructured processes tend to resemble cobbled-together, fragmented workflows that rely on endless email threads and too many spreadsheets. Structuring your AP process can create a more organized system in which it’s easier to find and follow information and prevent costly errors.

3. Better traceability for all stakeholders

Sharing updates and notifications with requesters, suppliers, and internal approvers is a time-consuming activity that usually requires constant back and forth between different systems and tools to find and share information. This not only makes it hard for the AP team to keep on top of the status of requests, but it also blocks visibility for all stakeholders involved.

A structured AP process that centralizes information and streamlines collaboration, keeps stakeholders informed of key information before they even request it, and reinvests time spent on manual updates into improving the AP process.

4. Stronger relationships with suppliers

Another benefit of a structured AP process is that it supports better relationships with suppliers by improving consistency and collaboration. As a result, vendors may be more inclined to negotiate prices or offer more favorable terms.

5. Faster payment cycles

Structured processes see fewer delays, errors, and broken handoffs. Structured processes speed up approval flows and produce more consistent outcomes. As a result, payments are processed more quickly.

6. No incurred interest cost, fees, or penalties

Shorter payment cycles save money. That’s because they help teams avoid the penalties and higher interest rates that often occur when invoices are paid late. These faster payment cycles can also make it easier to secure discounts for paying early or within terms.

7. 360-view of process and supplier performance

It’s easier to monitor critical metrics and measure performance when the AP process is structured. Keep up with metrics and KPIs, as well as supplier performance.

This benefit unlocks the ability to continuously improve the accounts payable process and archive greater P2P efficiency. Quickly identify AP process improvement opportunities and keep on top of supplier performance to better inform the purchasing process.

Accounts payable process steps and workflows

The accounts payable process involves making accurate and timely payments. It begins when goods are received or services are rendered and an invoice is issued by the supplier. Once the invoice is received, the AP process is set in motion. Here are the steps of a typical AP process.

Step 1: Review invoice information

Once an invoice is received, the first step is to confirm that the invoice is not missing any key information. During this step, the AP team or person will review the invoice to ensure that all necessary information is included in the invoice, such as:

- Billing information

- What was ordered

- What was delivered

- Total quantity of units

- Pricing per unit

- Total value of order

- Date of invoice issue

- Payment due date

- Credits or discounts

If any information is missing, the team will have to contact the supplier. Once this step is completed, it will be input into the accounting system — either manually or automatically with a software solution. The latter pulls data from existing purchase orders, so it streamlines and speeds up the data input and review process and prevents errors or mistakes.

Step 2: Three-way match invoice to purchase order and receipt

After all information has been collected, it will need to be matched to the original purchase order and the shipping receipt to confirm that the amount invoiced is in alignment with what was requested and what was delivered. This is called 3-way matching, and it verifies the invoice received is legitimate and accurate.

Step 3: Apply discounts, credits, and adjustments

Once the invoice has been matched with the receipt and purchase order, it’s time to apply any negotiated discounts, buyer credits, or purchase adjustments. Discounts and credits are commonly discussed during the negotiation phase of the purchasing process, so usually there is already an idea or documentation of this. Any other adjustments — such as missing products, overcharging, or late delivery — will need to be calculated in order to determine their value.

Step 4: Approve invoice

Once the invoice has been confirmed to be accurate, not fraudulent, and approved by the accounts payable department, the invoice is approved and payment can be released.

Step 5: Release payment

After the invoice has been approved by AP stakeholders, payment is issued or released.

Step 6: Notify stakeholders

Once payment is released and recorded, suppliers are notified that the payment has been issued. This step can either be managed manually or it can be automated so an alert or notification is issued once payment is released.

Step 7: Update balance sheet

The accounts payable process is considered complete and the payable is counted as paid. Depending on whether your process is manually operated or automated, this final step will need to be completed either by hand or automation.

How automation improves AP workflows

Manual processes are time-consuming and prone to errors. These are problems no AP team can afford.

Many of the benefits listed above can be achieved by manually making improvements and optimizing the accounts payable process, but that can be time-consuming, expensive, a heavy burden on both AP and IT teams, and, most importantly, unsustainable due to the nature of these rigid improvements. This can also limit the efficiency of P2P and widen the opportunity for P2P risks to swell and cause financial leaks within procurement.

However, with process management and automation software that prioritizes business agility, optimizing the accounts payable process is quick, easy, and tailor-made to your needs — as well as the needs of stakeholders and suppliers.

There are many manual steps in the accounts payable process, but AP automation can mitigate manual, time-consuming, and error-prone activities and build more resilient AP and P2P processes.

Advantages of AP automation

| For requesters | For purchasing teams | For accounts payable | For suppliers and vendors |

|---|---|---|---|

| Streamlined request process | Automated notifications and assignments for approval requests | Auto-generated purchase orders from approved purchase requests | Invoice and payment traceability |

| Improved collaboration with purchasing team | Visibility into supplier performance | Automated payment reminders | Automated notifications and email updates |

| Purchase request traceability | Standardized forms for more accurate and complete request intake | Automated notifications and assignments for approval requests | Effortless collaboration with buyers |

| Quick access to purchasing policy for informed requests | More informed sourcing and negotiations | Better tracking and reporting of AP metrics and KPIs with built-in dashboards | No more missed or delayed payments |

| No more messy email threads, spreadsheets, or paper trails | Lower invoice processing costs | Faster onboarding times for new suppliers | |

| Higher potential for cost-saving or value-adding opportunities | Better use of existing financial tools, systems, or apps |

The bottom line

The benefits of process automation software reach beyond just automating tasks. AP automation creates value for the entire business, and the benefits achieved by the AP team impact the purchasing process and the larger procurement function, such as:

- Faster and more accurate 3-way matching

- Lower invoice processing costs

- Quicker payment processing

- Fewer matching errors to prevent overspending or fraud

- Better cash flow tracking

- Better understanding of company spending and inefficiencies

- Seamless end-to-end P2P management

Tips & tricks for managing your accounts payable process

As you can see, there are many manual steps in the accounts payable process. To mitigate potential human errors, many companies step up their game by implementing AP best practices. A few of those activities include:

- Setting up payment reminders. Reminders help AP teams always pay vendors on time, which, in turn, supports vendor relationships.

- Creating traceable processes. Traceability allows AP and any other business sectors to review and substantiate all payments for audit purposes.

- Maintaining vendor relationships with automation. AP process automation can institute each of these best practices, plus it eliminates the need for paper and lessens the time and cost of AP processing. What is more, AP software often integrates directly with organizations’ ERPs. This makes the task of producing financial statements infinitely simpler.

Design a better, automated AP process with Pipefy

Any high-functioning business needs to keep its accounts payable in tip-top shape. Invoices need to be scrutinized for accuracy, in addition to being paid on time. And because this process normally requires a number of manual, tedious steps, the power of automating this process should not be overlooked.

Automating and streamlining the AP process saves your accounting team ample time, prevents easily avoidable costs or fees, improves sourcing, and makes you a more reliable buyer, which leads to additional discounts and better negotiations with suppliers.

With an automation software solution like Pipefy, manual processes and tasks are a thing of the past. Pipefy’s low-code framework and visual user interface simplifies AP process optimization by putting those closest to the process in charge of designing a more efficient process, automating redundant and time-consuming tasks, improving team productivity and process accuracy, and unlocking stack extensibility.