Last reviewed and updated by Team Pipefy on .

The procure-to-pay (P2P) process, also sometimes referred to as purchase-to-pay, is a structured workflow that involves receiving goods or services and issuing payments. Procure-to-pay is a part of the larger procurement process.

What is the procure-to-pay (P2P) process?

This process connects the purchasing department and the accounts (AP) department and directly influences a company’s financial projections and quarterly financial statements, which is why it’s important that the P2P process is connected and managed properly.

The procure-to-pay process is often automated in order to reduce risk and improve efficiency. Most often, procure-to-pay is managed with a low-code business process automation tool.

While this may vary based on company needs, the procure-to-pay process typically involves automated key features like:

- Selecting goods and services from a catalog of approved suppliers.

- Sending purchase requisitions.

- Creating purchase orders.

- Processing and reconciling invoices.

- Submitted approved payments.

Why is procure-to-pay important?

Procure-to-pay is important because it saves costs by reducing manual and laborious work, increasing accuracy, and improving efficiency and financial controls. A bonus benefit that the procure-to-pay process provides is enforcing compliance and order, which is essential for guaranteeing accuracy and maximizing contract values.

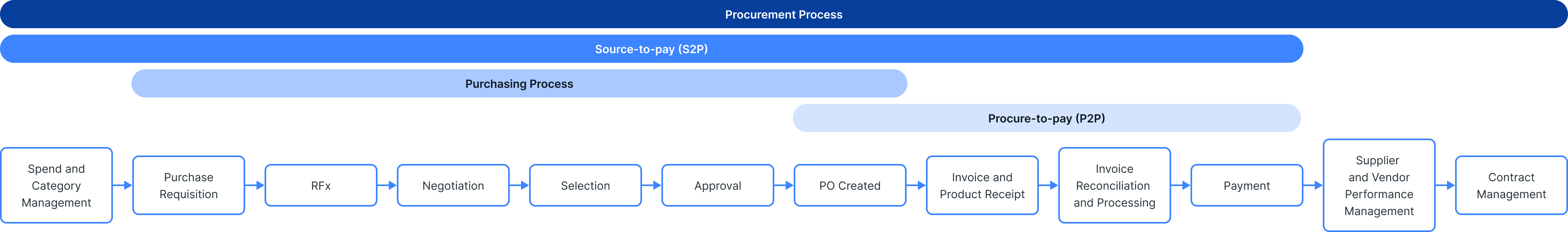

Procure-to-pay vs. procurement

Procurement is the process businesses use to source and obtain goods/services from external suppliers to achieve strategic objectives and fulfill business needs or purchase requests. While procurement is made up of many phases and steps, it can be broken down into two sections: purchasing (which falls under the purchasing process) and payment (which falls under the accounts payable process).

The procure-to-pay process integrates the purchasing and accounts payables processes. Procure-to-pay exists within procurement, not independent of it, and serves as a seamless connection between purchasing and AP to gain greater business efficiencies.

Procure-to-pay vs. accounts payable

Accounts payable represent a company’s short-term debts for goods, products, or services purchased on credit. The accounts payable process is a series of steps taken to complete payments for these purchases.

While both P2P and AP provide the same service, the key differences between procure-to-pay and accounts payable are that:

- Procure-to-pay is an end-to-end process that handles both purchasing and AP tasks, such as purchase requests, purchase orders, invoice reconciliation and approval, and payment for goods or services.

- Accounts payable handles incoming invoices and outgoing payments and begins once an invoice is received or submitted to AP.

Procure-to-pay vs. order-to-cash

Order-to-cash (also known as OTC or O2C) involves all the steps necessary to process customer orders. The order-to-cash process is handled by the accounts receivable department because it deals with the money owed to the company rather than the money owed by the company.

As the names imply, procure-to-pay deals with procuring and paying for goods or services, and order-to-cash deals with processing and receiving payment for customer orders.

Components of the procure-to-pay process

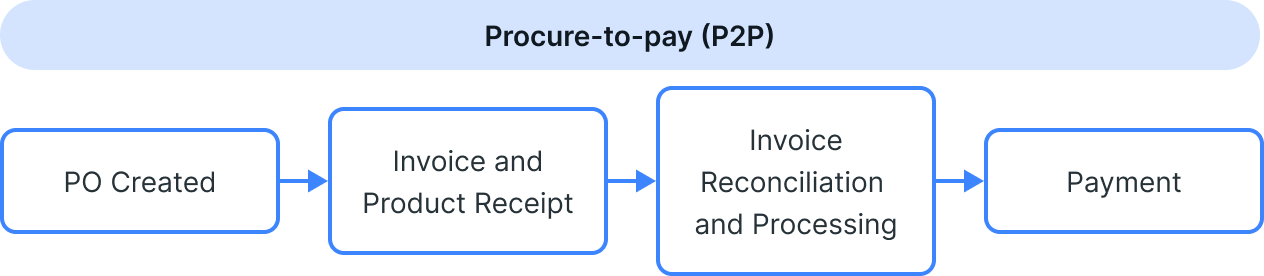

The procure-to-pay process is made up of four key steps: purchase request, purchase order, invoice processing, and payment issuing. By leveraging a procure-to-pay software solution, the P2P process can be streamlined and automated to minimize delays, errors, and potential risks that could negatively impact an organization.

The procure-to-pay process makes it easier for procurement and finance teams to:

- Select the best vendor for goods and services

- Enforce compliance and purchase policies

- Manage purchase requests, orders, invoices, and payments

- Improve purchase accuracy and payment efficiency

- Become better strategic partners

Below is a breakdown of the steps that make up the procure-to-pay process.

Purchase requisition

A purchase requisition is when a purchase request is submitted for approval to buy or acquire company needs, like goods or services. During this step, the purchasing team will:

- Assess whether the purchase request falls within the company purchasing policy.

- Determine whether the purchase request is a business priority or a necessity.

- Source the best vendor.

- Approve the purchase request.

Purchase order

Once a purchase request has been approved, a purchase order will be generated and submitted to the chosen vendor for fulfillment.

Invoice reconciliation

Once an order has been fulfilled and received, the accounts payable team will receive an invoice that will need to be reconciled and approved for the purchase. During this time, the invoice will be reviewed and approved against the original purchase order, the goods received note, and the invoice provided by the vendor.

Payment

Once the invoice is verified and approved, the accounts payable team will issue payment by the date specified in the original contract and/or invoice.

Common procure-to-pay challenges

Like any business process, procure-to-pay processes can experience issues that keep them from operating smoothly. These issues can stem from challenges related to:

- Adopting new technology

- Managing and efficiently implementing process integrations, changes, and optimizations

- Lacking an overall layer of governance and compliance control

- Contract management

- Data organization

- Invoice reconciliation

- Invoice processing costs

Find the right automation tool for your procure-to-pay team with the Definitive Guide to P2P Optimization

How AI Agents are transforming procure-to-pay operations

One of the most impactful evolutions in the procure-to-pay process is the use of AI Agents to enhance accuracy, agility, and control. Unlike rule-based automation, AI Agents operate autonomously across systems, interpreting data, making contextual decisions, and initiating next steps without manual intervention.

In P2P workflows, AI Agents can classify and route purchase requests based on company policies, historical behavior, and spend thresholds. They analyze data across multiple platforms to ensure compliance with procurement standards and identify anomalies in invoices or purchase orders.

A key benefit of AI Agents in this context is their ability to continuously learn and adapt. Over time, they become more efficient at handling exceptions, predicting delays, and prioritizing approvals based on business-critical factors. This not only accelerates turnaround times but also reinforces governance by ensuring decisions are based on consistent logic and up-to-date data.

Furthermore, AI Agents can integrate with both ERP and procurement systems, enabling a seamless flow of information and reducing communication gaps between teams. This integration supports finance, compliance, and operations leaders in maintaining real-time visibility and control over the entire procurement cycle.

Learn how companies are achieving greater speed and accuracy with AI Agents from Pipefy.

Benefits of the procure-to-pay process

Given the numerous parties and steps involved in the procurement process, there is significant room for automation to improve workflow efficiencies, lower costs, and build better relationships with suppliers. With procure-to-pay solutions, teams can:

Streamline procurement

Approvals, requisitions, purchase orders, notifications, and payments are processes that follow basic and consistent rules. Automating this can reduce friction and improve efficiency to make the procurement process much leaner and minimize the propensity for error.

Reduce costs

In addition to making the procurement process more consistent, automation can reduce the costs associated with maintaining them. The more steps you can automate, the more man-hours can be reduced or assigned to more productive tasks.

Gain total visibility into purchasing

By tracking each step of the process and centralizing data through stack extensibility, managers have a complete picture of historical and planned purchases and expenditures.

Strengthen relationships with vendors and suppliers

By speeding up approval and payment processes, vendors receive purchase orders quickly and get paid on time. Everyone benefits from predictable, smooth processes.

Negotiate with authority

Negotiations are about business leverage and access to information. Automation gives a business the flexibility to choose from a larger pool of vendors because managing those vendors is less of a burden.

Procure-to-pay: 9 steps of an efficient process

While every business is unique, most companies will follow a common series of steps for their procure-to-pay process. Below is a detailed breakdown of the seven core steps that make up the procure-to-pay process, plus some bonus steps to build a more resilient procure-to-pay process:

Step 1: Create a purchase requisition

When an employee needs to purchase a good or service, they create a document called a purchase requisition and send it to a manager for approval. Depending on the purchase amount, the purchase requisition may require multiple approvals.

Step 2: Select a vendor

After a manager approves a purchase requisition, employees must consult an approved-vendor list when deciding where they’ll purchase the item(s). This decision may involve factors such as industry, location, and price.

Step 3: Create a purchase order

A procurement employee then creates a purchase order (PO) to send to the chosen vendor. Depending on the size and type of purchase, there may be multiple POs sent to multiple vendors.

Step 4: Receive goods and services

After the vendor(s) receive the purchase order(s), they deliver the goods or services to the purchaser. Assuming there are no issues that the vendor must address, procurement managers approve the transaction and mark the purchase order as “‘fulfilled.”

Step 5: Receive an invoice matching the purchase

The vendor issues an invoice to the purchaser that includes the amount owed and the due date. The invoice will specify the goods or services provided.

Step 6: Reconcile and approve the invoice

In order to appropriately determine the status of the purchase, the vendor invoice must be reconciled with the original purchase order. When the purchaser and other managers formally indicate that they’ve received the product/service, the invoice can move on to the payment process.

Step 7: Pay the vendor

Finally, the procurement department sends the approved invoice to the accounts payable team, who schedules the payment. Typically, this results in an outgoing payment via a check, ACH, or wire transfer to the vendor’s bank account. However, there may be different payment requirements, particularly for international transactions.

Step 8: Analyze performance and identify bottlenecks or points for improvement

Similar to any process, the procure-to-pay process will require consistent maintenance in order for it to continue running efficiently and effectively. After all, a solution or step that works well now may not necessarily work as well in 9 or 12 months.

Learn more about process improvement steps and best practices.

Step 9: Update supplier performance

During this time, it’s also important to assess supplier performance. Were goods received or services rendered at the agreed-upon delivery time? Is the quantity, quality, and cost correct per contract agreements?

The same way tracking employee performance is important, so is tracking supplier performance. By keeping an updated supplier performance database, teams are better equipped to negotiate terms, manage the accounts payable process, and improve cost savings and business performance.

What is three-way matching in P2P?

Three-way matching is the process of verifying three key purchase documents: the purchase order, the invoice, and the goods received note. This matching process ensures that the items received align with what was purchased and that the payment requested is accurate to what was received. Once all three items have been verified and approved, the payment can be released to the vendor.

Procure-to-pay solutions and best practices

Using a solution like low-code BPA software to automate the procure-to-pay process will ensure that the steps are performed consistently, efficiently, and affordably. It also is a scalable solution that can enable the procurement department to manage large operations without having to increase staff to handle all the moving parts.

Here are some best practices to keep in mind as you build and optimize your procure-to-pay process:

Leverage a procure-to-pay software solution

Procure-to-pay software builds a stronger link between procurement and accounts payable departments by automating repetitive or manual tasks, increases process efficiency, organizes invoices and contracts, and leads to higher time and money savings.

With procure-to-pay software, companies can become more financially efficient by reducing the transaction costs of the company’s procurement activities.

Learn more about procure-to-pay automation.

Automate when and where you can

In traditional procurement workflows, the request and approvals steps usually are the most time-consuming and error-prone steps. Workflow automation software can help standardize request creation, define requirements that must be completed to ensure consistency and quality, quickly send and track active approvals, and designate rules about who needs to approve certain types of purchases.

Centralize your procurement process to skip rework and improve efficiency

Centralize all of the information about ongoing and historical procurement processes so that no one has to waste time scrounging through documents or emails to understand the state of a project. This also helps to ensure that information is not lost and steps are not forgotten.

Trends in procure-to-pay: from automation to autonomous execution

The procure-to-pay process is evolving from automation toward autonomous operations. This shift is driven by the growing adoption of AI Agents, no-code tools, and real-time data integration. Together, these technologies allow procurement and finance teams to manage complex tasks with greater efficiency and less intervention.

AI Agents now go beyond task execution. They interpret purchasing policies, assess risk signals, and support vendor decisions based on up-to-date information. Their ability to connect with systems like ERPs, compliance databases, and procurement tools enables smoother operations and faster response to exceptions.

For finance and operations leaders, this opens the door to faster cycle times, fewer manual approvals, and improved alignment between purchasing and accounts payable. Teams can refocus their efforts on strategic initiatives while maintaining control over contracts, budgets, and compliance.

Another trend shaping P2P operations is the move toward modular procurement stacks. Instead of relying solely on legacy ERPs, organizations are choosing platforms like Pipefy to build workflows tailored to their needs. These platforms offer greater flexibility, and when combined with AI Agents, they adapt to changes in process logic, scale easily, and provide real-time insights.

This direction isn’t just about technology—it’s also about changing how work gets done. Routine tasks like validating documents, tracking payments, or flagging compliance issues no longer require constant human supervision. As AI Agents become more embedded, teams gain time to focus on supplier relationships, cost planning, and performance analysis.

Learn more about how Pipefy’s AI Agents support this shift in procure-to-pay operations.

Gain control and visibility over your procure-to-pay process with Pipefy

A well-designed and implemented procure-to-pay process can help to improve the efficiency and quality of the procurement process in a scalable manner — and Pipefy’s low-code automation platform can help do that.

When you need to take control of your finance department and procure-to-pay process with the big picture in mind, Pipefy is the perfect partner. Pipefy improves workflows by adding automation that cuts repetitive, time-consuming tasks, and streamlines communication and connections between teams, departments, and processes.

Pipefy’s platform centralizes operations by easily integrating with your favorite software to unlock a seamless, streamlined, accurate, and secure, procure-to-pay operation — all from a single platform.