ARTICLE SUMMARY

Finance process automation can help speed up processes, reduce errors, and improve vendor, customer, and employee experiences.

Businesses depend on technology to solve complexities in their finance processes.

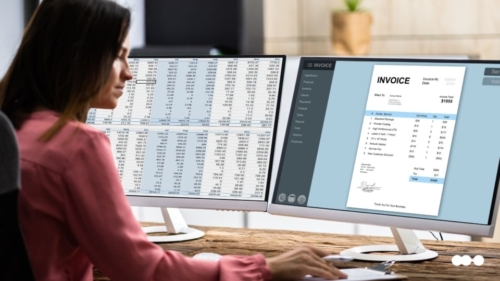

Payments must be processed, invoices generated and sent, and invoices must be matched to purchase orders and proofs of receipt. Every workflow and process in the finance department involves a range of people, systems, and data. Automation helps coordinate all the moving parts by eliminating manual tasks, enhancing collaboration, and keeping work items in motion.

Keep reading to learn more about this business solution, or feel free to skip ahead to the section you need using the jump links above.

Definitive Guide to Workflow ManagementDownload guide

Finance automation definition

Finance automation involves the use of technology to complete tasks with little or no human input. This isn’t to say that it replaces people with robots. It simply means using automation to handle repetitive, time-consuming manual tasks. By automating these aspects, finance departments are able to direct their efforts toward creating value and driving strategy.

The primary goal of finance automation is to improve process efficiency by reducing or eliminating repetitive tasks or activities that do not add value. Automation also plays a key role in achieving business process excellence.

What are the benefits of finance automation?

Finance teams that rely on manual processes and tools like email and spreadsheets to manage financial data and operations are prone to confusion, data loss, and errors. By standardizing, automating, and integrating these processes, teams minimize mistakes, improve collaboration, and increase overall productivity.

The benefits of financial process automation include:

| Reduces errors | Automating data collection provides full visibility into all the moving pieces in finance pipelines, like contracts, invoices, vendor information — without toggling between multiple tools or sorting through information manually. Finance automation software that integrates with other common financial tools, such as QuickBooks and Excel, serves as the missing piece that ties all aspects of your finance operations together. |

| Brings visibility to finance process | Collects data and provides full visibility into all the moving pieces in finance pipelines, like contracts, invoices, vendor information — without toggling between multiple tools or sorting through information manually. |

| Streamline and expedite approval flows | With automation, reviews and approvals don’t become a bottleneck in finance processes. Use rules to ensure that no transactions are completed without proper approval in place. |

| Improves efficiency | Use dashboards to measure how well processes are working, and to analyze potential bottleneck causes. |

| Enhances collaboration | Make it easy for anyone to create a request, and even easier to track, view, and report. Customized form fills add consistency to your processes, and triggered emails and notifications mean fewer routine tasks for you to worry about. |

| Leaves more time for strategic work | When processes are organized and manual work is automated, teams can spend less time trying to understand how to perform a specific process, and more time crunching the numbers, building reports, and making sound business decisions. |

Low-code BPA vs. robotic process automation in finance

Business process automation uses software to improve overall efficiency and generate additional business value by getting rid of time- or resource-consuming work. BPA doesn’t replace human intervention, but it does work to eliminate it when not necessary or potentially limiting, like data input or IT development.

Robotic process automation (RPA) uses software bots that “learn” how to identify issues and how to imitate the way humans work and navigate applications to improve a single process. This means it not only works to eliminate work when not necessary like BPA, it also works to eliminate human intervention completely.

While these two practices have their differences, the two provide their own benefits and can even be used together to help organizations achieve a total digital transformation that improves the overall employee, vendor, and customer experience.

| Low-code BPA | RPA |

|---|---|

| Automation at an end-to-end level that can improve cross-functional collaboration | Automation at a task level that can improve productivity |

| Solution requires a full understanding of business processes and may take longer to implement | Solution “learns” how a business process or task is completed, which means it can work within an existing process as-is |

| Low-code interface makes it easy for non-technical business users to build and improve easily repeatable frameworks, improving overall security and governance | Requires coding knowledge to set up and make updates, which may lead to potential bottlenecks and security and governance issues |

3 examples of finance process automation

Finance teams often struggle to balance all the moving parts needed to keep their businesses healthy. Managing finances through email, spreadsheets, and disparate finance automation tools adds confusion and increases opportunities for error.

Standardizing and automating these processes can help your team minimize mistakes, improve collaboration, and increase productivity. Here are three examples of automation use cases:

Accounts payable

An accounts payable department typically includes several manual processes, such as:

- Making sure invoices are properly approved before issuing payment

- Ensuring sufficient funds for each payment

- Adhering to payment terms that vary from one vendor to another

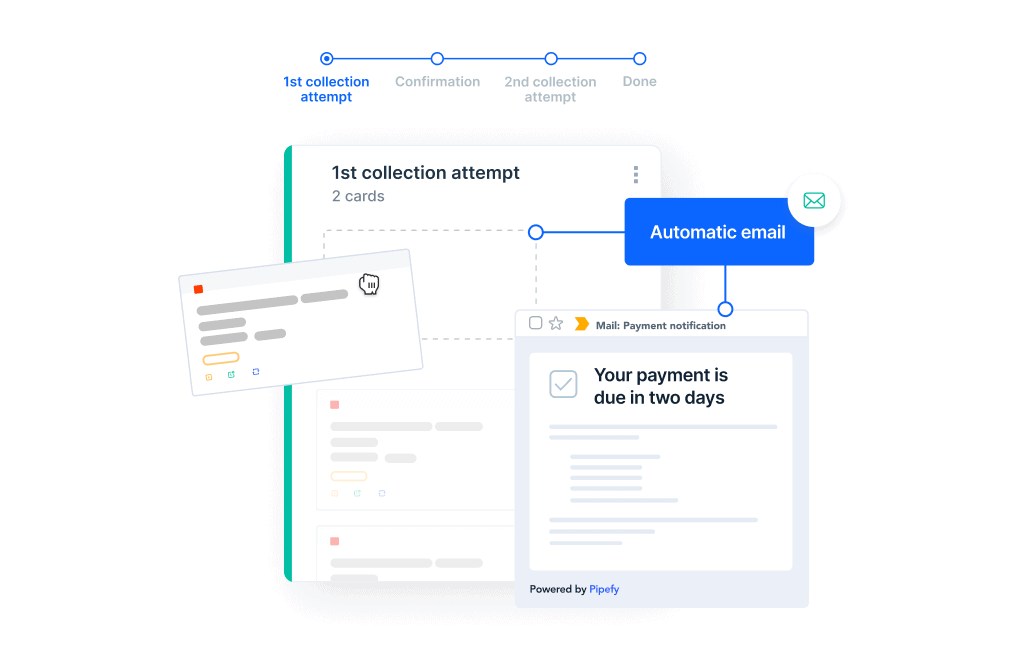

Finance automation software addresses these processes by connecting your accounts payable system directly to purchasing or reimbursement workflows to be sure you process only approved invoices.

You can also use automation to integrate accounts payable processes with financial planning tools so that budget is allocated automatically before invoices reach accounts payable.

Expense reimbursement

Reimbursement requests that seem straightforward can become backlogged when there are many employees submitting requests in multiple channels. Common challenges include:

- Employees running afoul of expense policies that may be unclear

- Poor visibility into expenses because of unstructured forms or lack of integration with other systems

- Delayed reimbursements due to expense reports that are filed late, or are missing information

Finance automation software can address these pain points by:

- Providing a repository for clear information on common travel costs

- Providing a structured workflow for each reimbursement request

- Sending automatic notifications to approvers

- Allowing employees to track the status of their requests

Integration with other financial systems — such as Quickbooks, Oracle or ERP software — can provide historical data so expense trends can be analyzed easily.

Purchasing and procurement

The ad hoc nature of many purchasing requests results in purchase requisitions with missing, erroneous, or incomplete information. Common problems include:

- Lack of spending control and visibility due to impromptu orders and purchases made outside the company procurement process

- Incomplete or inaccurate data due to unstructured request forms, manual data entry, or receiving requests from multiple channels

- Contract compliance issues that arise when a finance department must examine the contractual obligations of multiple suppliers

Avoid these issues by using finance automation software to standardize purchase request creation, and set purchasing conditions, mandatory actions, and automation rules that prevent errors and ensure policy compliance when purchasing requests are processed.

10 essential low-code finance automation software features

Finance processes are complex, but they don’t have to be complicated. With the help of BPA software, you can bring control, accountability, and efficiency to your team’s work and finance workflows. To help you get started, consider a low-code platform that has the following features:

The result is not only a smoother overall financial operation but also greater business agility, because financial processes no longer become bottlenecks for other business workflows. With the right software, you’ll also find it easier to centralize information and improve communications within your department, as well as with vendors and customers.